If you follow ITR Economics or have heard any of our speakers lately, you have undoubtedly heard us say that we expect a "soft landing" for 2023. It is important to note that the soft landing we are talking about is for the macroeconomy – namely US Industrial Production and US Real Gross Domestic Product (GDP). There will be many markets and companies that also experience soft landings, but there will also be some markets and companies that face hard landings – or recessions – in 2023. It is critical to know which future to expect for your business.

What Is a Soft Landing in the Business Cycle?

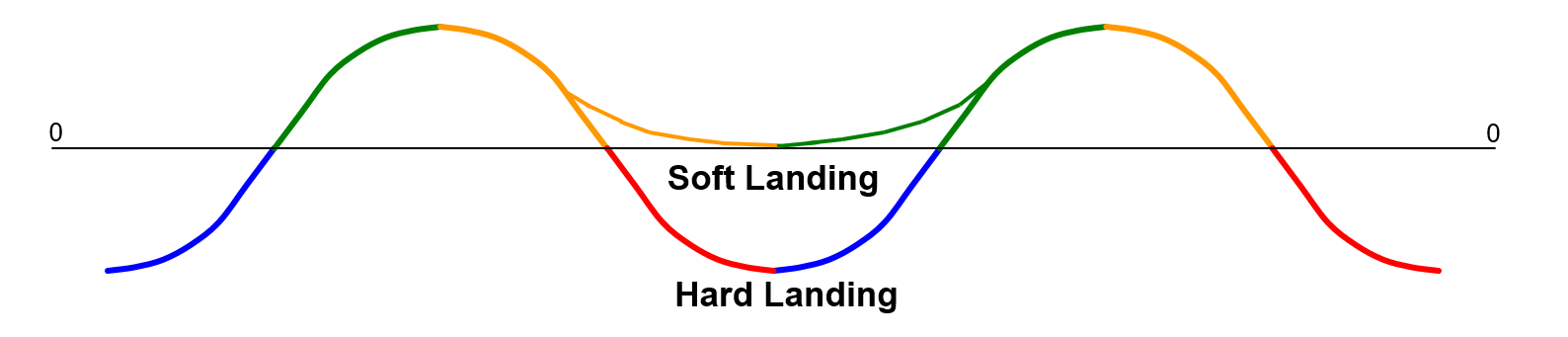

Before we get too much further, let’s make sure we are all speaking the same language when we say "soft landing." Consider the graphic below. The line represents your annual growth rate (a 12/12 rate-of-change per our terminology), measured as the percent change between the most recent 12 months of data and the previous 12 months of data. When the line is above zero it represents year-over-year growth; below zero represents year-over-year contraction.

A soft landing is when the subject series (indicator or company) goes through the bottom of the business cycle with the rate-of-change staying positive. Putting it into ITR terminology, your Phase C, Slowing Growth (yellow line), gives way to Phase B, Accelerating Growth (green line), rather than Phase D, Recession (red line). If you subscribe to the ITR Trends Report™, you are likely familiar with this illustration.

Can My Business Avoid a Recession?

So, how do you know if you are heading for a soft landing or the dreaded hard landing? Understanding how you compare to key benchmarks like US Industrial Production and US GDP is a good first step. Beyond that, you need to know what is expected of your key markets through 2023.

An example is US Mining Production (excluding oil and gas). Mining Production typically moves through business cycle turning points at the same time as US Industrial Production, and that is expected to hold true through 2023. However, the severity of the cycles will differ. Mining Production is projected to contract 1.2% year over year at the mid-2023 business cycle low while US Industrial Production grows through the same time period. US Chemicals and Chemical Products Production, expected to contract 1.6% year over year at its 2023 low, tells a similar story.

[ Looking to propel your business forward? See how taking certain risks can help you grow. ]

How your business compares to the macroeconomy and your specific markets makes a significant difference, too. Many of our clients outperform their markets at the peak of the cycle but also underperform them at the bottom.

My advice to you is this: just because you have heard us talk about a soft landing doesn’t mean you can become complacent and expect smooth sailing through the next two years. The ITR Trends Report clearly shows more than a handful of markets that are heading for recessions in 2023, and that isn’t counting those that will go through hard landings in 2022. Know exactly how you relate to your markets. You do not want to be caught going into recession next year because you assumed a universal soft landing.