Halloween is over, but something spooky still stalks the business world.

Zombies!

Zombie companies, that is.

A zombie company is a company that is only able to stay in business through borrowing or bailouts. Zombie companies may be able to pay the interest on their debt, but they cannot repay the principal and will require further credit to stay afloat.

The pandemic-induced economic disruption of 2020 likely created many zombie companies. But, as in a bad horror movie, their true nature will not be immediately evident. Many of these firms have relied on extraordinary support from the government to remain in their twilight zone of viability, using resources that could be diverted toward healthy companies.

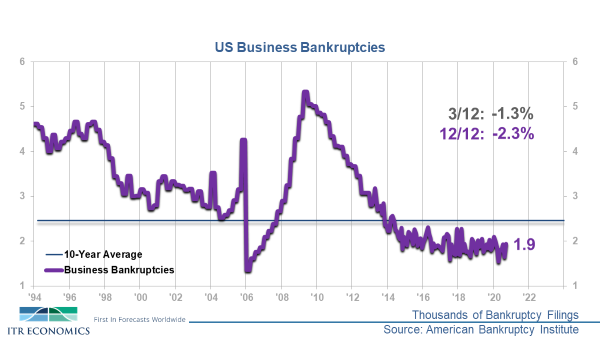

Data through September indicates that US business bankruptcies remain relatively low at just 1.8 thousand filings, well below the 10-year average. However, this measure may obscure the actual health of US corporations, as years of near-zero interest rates have allowed undead firms to finance continued operations. The Federal Reserve’s response to the COVID-19 pandemic further reduced borrowing costs and eased credit conditions, potentially allowing zombies to multiply.

So, what can you do if you feel surrounded?

- Be aware of the zombies around you: Risks may come from suppliers, distributors, or customers. Evaluate the financial strength of firms on which you rely, and don’t be caught off-guard by incidents at other companies that may affect you. Many customers will be asking for generous invoicing terms in the current economic environment, but we recommend against chasing business at the expense of reasonable payment terms from questionable customers.

- Don’t buy one: If you are actively pursuing acquisitions, be aware of the existence of these zombie firms and ensure that you take a realistic view of a target company’s growth projections. Even the most attractive valuation won’t matter if you end up with a zombie in your house! ITR Economics offers one-time forecasting programs to help you evaluate a target company’s growth prospects.

- Don’t become one: Honest, straightforward scrutiny of your own firm’s position is critical. Evaluate your balance sheet and cashflow position and ensure that you are implementing the Management Objectives™ pertinent to your current phase of the business cycle. In doing so, you can escape the zombies and move forward with confidence into the macroeconomic recovery expected in 2021.

Lauren Saidel-Baker

Economist