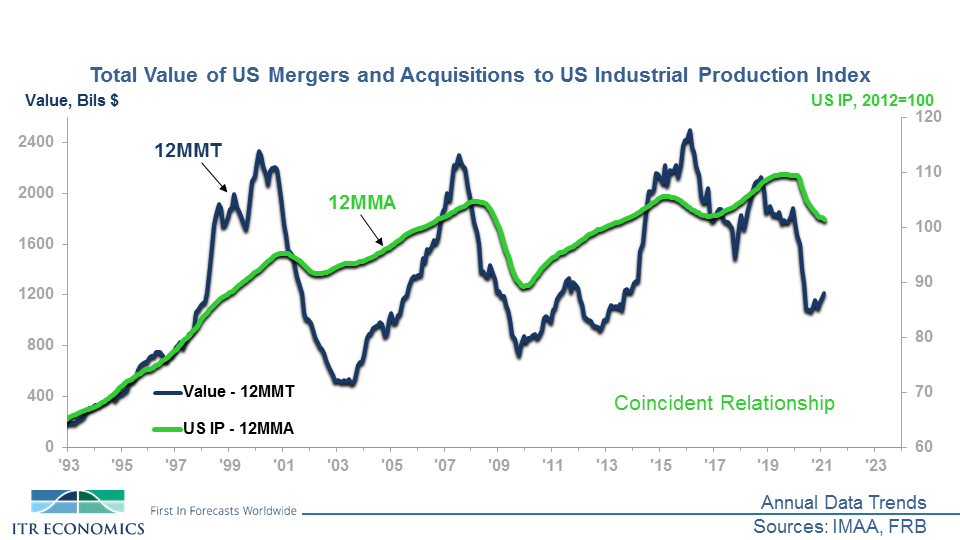

We use US Total Industrial Production as one of our “benchmarks” for the overall economy. GDP is another one. We provide forecasts for these benchmarks in multiple ITR onDemand formats because knowing where the overall business cycle is going is extremely useful in formulating profitable plans. An example of using one of these benchmarks is charted below. The conclusion drawn from the chart is that the Total Value of Mergers and Acquisitions in the US is shifting into a sustained rising trend. This could be broken down further into market types and multiples to further facilitate planning.

The green line on the chart is US Total Industrial Production (12MMA - annual average index). Our clients know that the Total Industrial Production trend line will be moving higher shortly because of the material we provide them. Knowing that the business cycle is shifting into sustained ascent supports the expectation that the nascent onset of rise discernible in the Total Value trend (12MMT - annual total in billions of dollars) will continue. A deeper dive using the rates-of-change affirms that a shift is occurring. The relationship to Total Industrial Production coupled with our track record in being able to accurately forecast the benchmark series means it is time for interested parties to determine if the new trend is advantageous to them, and whether there is a need to act now, or if it is wiser to wait until we are nearing the end of the rising trend. Your M&A professional consultant will guide you on that issue, but you should know the trend and attendant circumstances are changing.

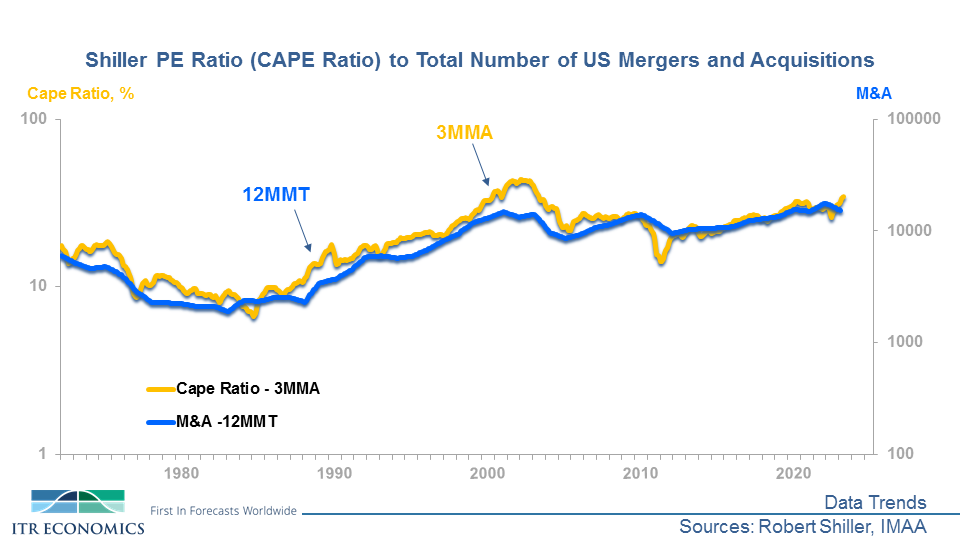

The Total Number of deals is rising along with the Total Value. Evidence of this can be seen via the chart below. The M&A relationship is one of several reasons why we may discuss what is happening in the stock market during our presentations. We look at Shiller’s Cyclically Adjusted Price Earnings Ratio (CAPE, 3MMA) because it is one of the gauges that helps us discern if the stock market is getting “expensive” and/or what the forward look on returns might be. The CAPE is currently rising, at least partly as a result of the relatively extreme monetary policy easing put in place because of COVID. The chart also shows the Total Number of US Mergers and Acquisitions (12MMT data trend ). The Total Number of deals will come down when the CAPE shifts from rise to decline, and the former likely won’t bottom out until the market corrects into the next rising trend. If you are a buyer or if you are on the other side as a seller, you will need to work either the rising trend or the declining trend into your calculations/plans.

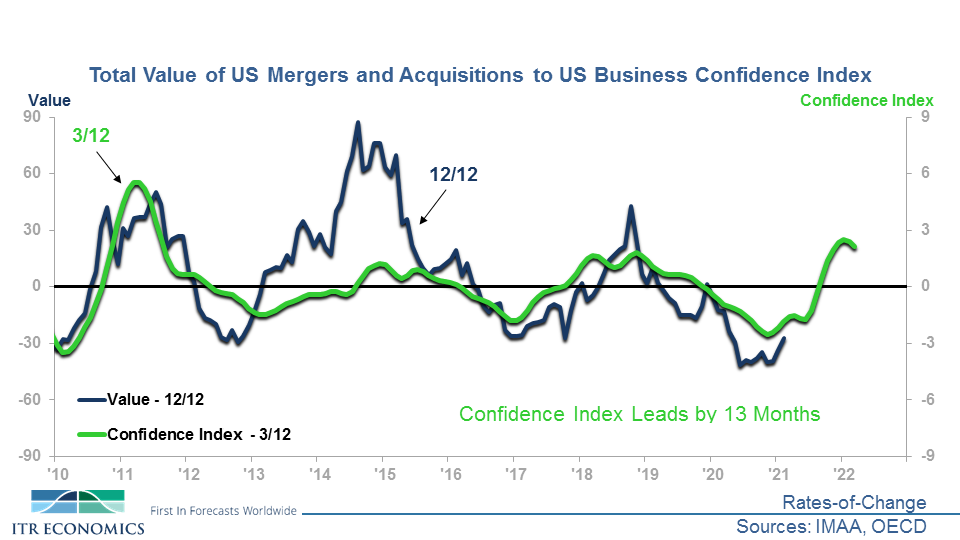

The third chart (below) demonstrates that there is an underlying logic to what is going on. The green line is the 3/12 rate-of-change for Business Confidence. The trend shows that confidence for the three months ending in January 2021 is averaging higher than the same three months one year ago. Note that confidence is running higher than it was pre-COVID. That is a good indication that not only are there going to be more deals, but that Total Valuations are going to rise. This tends to be affirming input for what we saw using the Total Industrial Production benchmark, but comes at it from a different angle.

Bottom line is that the M&A market is on the move. Total Value and Total Number are both rising. With interest rates staying low (for now), multiples will likely favor the seller. There is a lot more to consider than age and taxes when deciding when to buy or when to sell the business. Benchmarking to the business cycle can add significantly to your side of the transaction. We can help.

Brian Beaulieu

CEO