The Cass Freight Shipments Index1 is showing a strong increase in freight volume following normal seasonal declines in November, December, and January. Freight volume through March is the highest in 17 months and up a steeper-than-normal 5.8% from February’s level. Clearly freight is moving, but not enough to satisfy everyone’s demand.

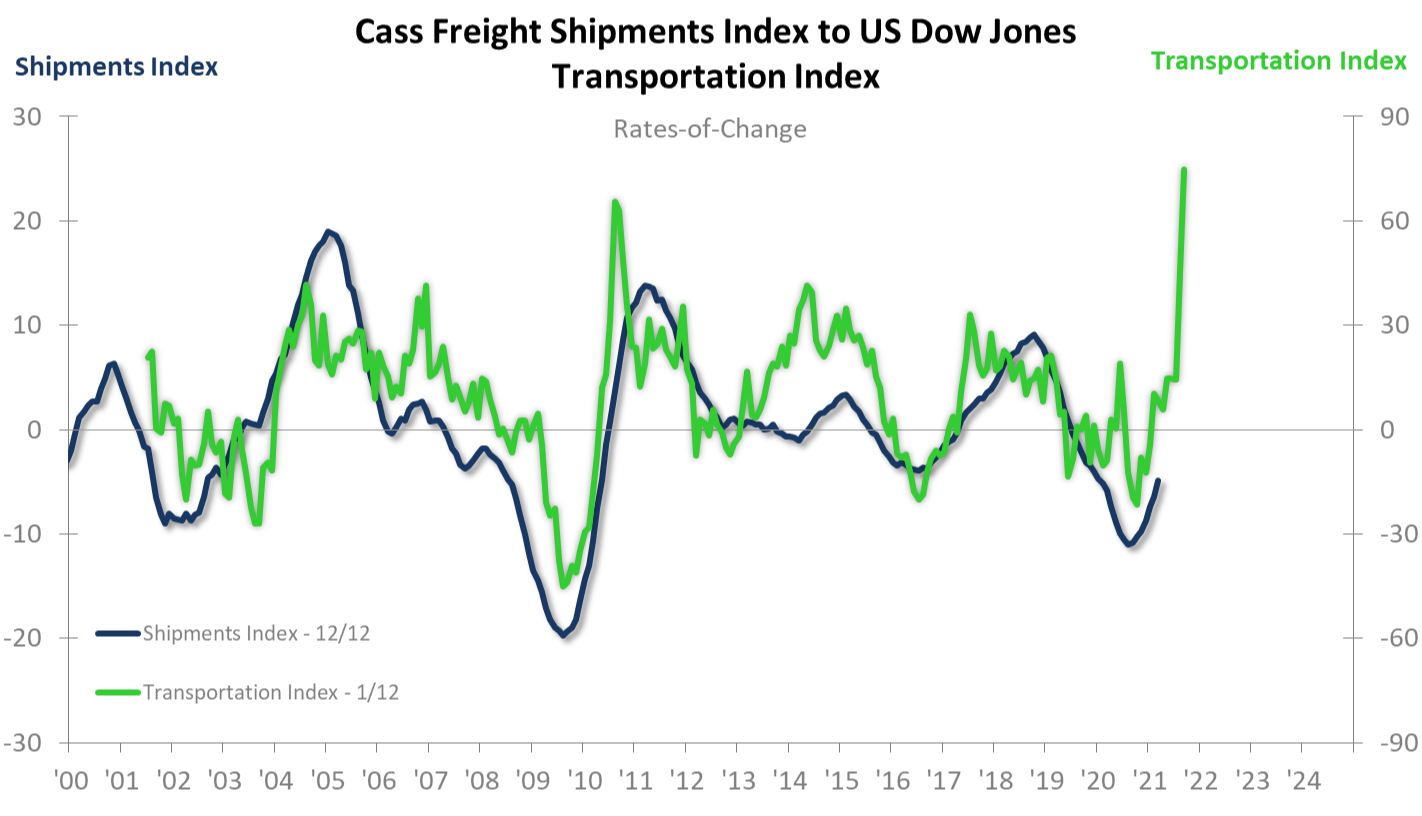

There are two items to note as we investigate the future of freight this year. One is that the volume of freight will continue to increase. There are numerous leading indicators to support that outlook, including the US Dow Jones Transportation Index. The chart below shows that the Dow Jones Transportation Index 1/12 leads the Cass Freight Shipments Index by a median of six months. The current rising trend in the Transportation Index 1/12 portends 12/12 rise in the Shipments Index through the third quarter of this year, as does our ITR Leading Indicator™. Businesses frustrated by shipping constraints can look forward to increased freight movement as the year progresses.

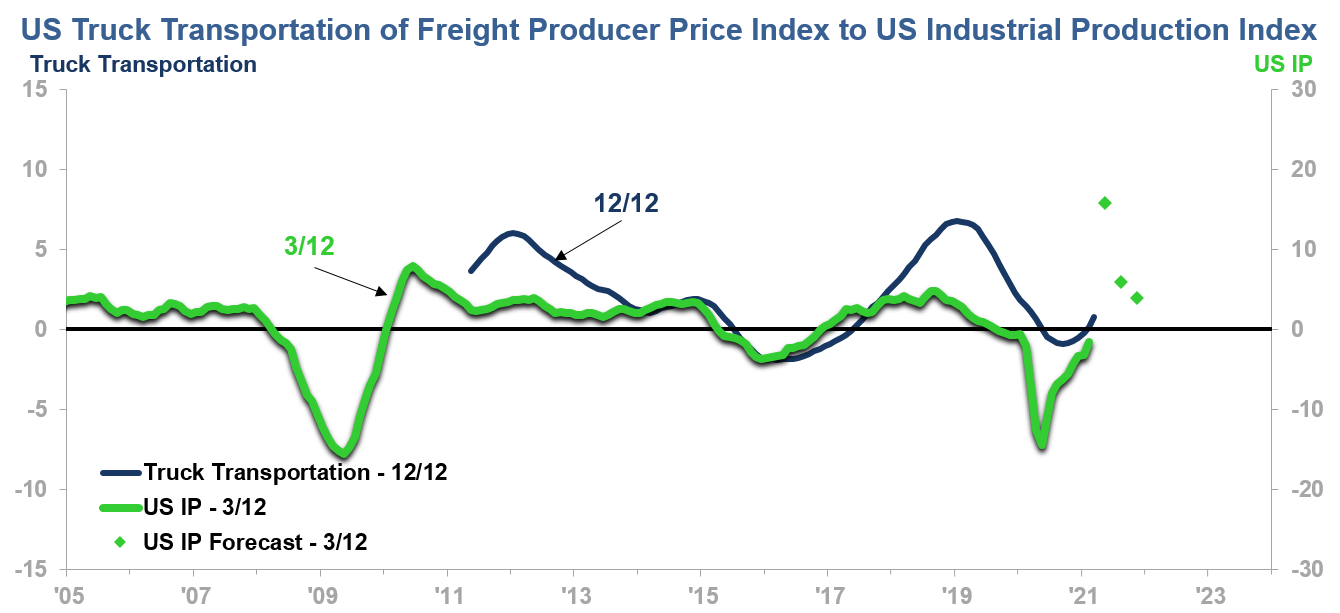

The second item to note is that freight costs are likely to move higher through 2021, though the rate of rise is expected to slow noticeably in the second half of the year. The chart below compares the US Truck Transportation of Freight Producer Price Index (PPI) to the US Industrial Production Index.

Our forecast for the US Industrial Production 3/12 rate-of-change (green diamonds on the chart) calls for a June 2021 high. The 3/12 will then move into Phase C for the second half of the year. Expect the Producer Price Index to track similarly. The PPI 12/12 can be expected to peak around mid-2021, followed by 12/12 decline in the latter half of the year. The second-half-of-2021 decline in the PPI 12/12 will signal a slowing in the rate of rise in freight prices, not an immediate cessation to price rise. A forecasted slower rate of rise in the US economy in general in 2022 should provide time for the freight industry to catch up on demand, reducing frustration for everyone dependent on freight movement and further reducing the upward pressure on freight costs. Fuel and labor costs can be expected to move higher in 2022, but the bidding for freight space can be expected to ease.

Readers should compare their own shipments 12/12 rate-of-change through time to the Cass Freight Shipments Index and to US Industrial Production. These comparisons, and our outlooks for each of the two metrics, could yield valuable insight as to volumes you will need to plan on. Readers should also compare their shipping costs 12/12 to the US Truck Transportation of Freight Producer Price Index. Cost correlations are likely to be evident, which would provide further intel for your 2022 pricing strategies.

1Data within the Index includes all domestic freight modes and is derived from $26 billion in freight transactions processed by Cass annually on behalf of its client base of hundreds of large shippers. These companies represent a broad sampling of industries including consumer packaged goods, food, automotive, chemical, OEM, retail, and heavy equipment. Annual freight volume per organization ranges from $1 million to over $1 billion. The diversity of shippers and aggregate volume provide a statistically valid representation of North American shipping activity.

Alan Beaulieu

President