China is leading the way, but not the way you might think. China Industrial Production is the first major economy to slow in its rate of rise , as indicated by the March high in the 3/12 rate-of-change. The decelerating rate of rise is going to define China’s industrial economy through 2022.

Regular readers are neither surprised nor alarmed by this, as we have been forecasting the 2022 slowdown since March 2020 , when economies moved to a pandemic-caused shutdown. This is not an ominous harbinger of economic pain, but it is a clear signal of Phase C ahead at the macro level and for the need to adjust expectations for the rest of this year and into 2022 for many companies. First, it is important to be sure the slowdown will continue before proper actions can be put in place.

Deceleration Ahead

ITR uses a host of leading indicators to see the future first. The China Leading Indicator is signaling a late-2021 high in the China Industrial Production 12/12 . Power generation in China has a strong predictive correlation to changes in Industrial Production, and the China Power Generation 3/12 places the Industrial Production 12/12 peak in late 2021. Railway Freight Carried is another important leading indicator, and it joins the chorus in signaling a late-2021 China Industrial Production 12/12 high.

These indicators place the China Industrial Production 12/12 in Phase C in 2022. (Please see our website for additional information on rates-of-change, phases, and how to use them to see the future and manage your company through the business cycle.) A typical length of decline off a late-2021 high places the next 12/12 low in early 2023.

ITR is forecasting that a decelerating rate of rise will also occur in the US, Canada, Mexico, Europe, and Brazil, and in overall World Industrial Production.

A Clear Signal

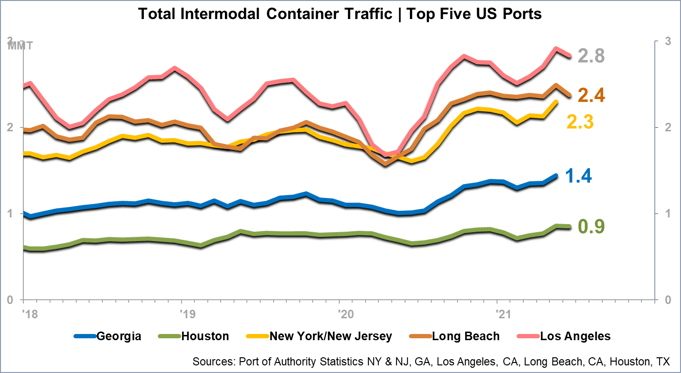

Slowing growth in China now (3/12 signal) and through 2022 (12/12 outlook), accompanied by slowing growth in World Industrial Production in 2022, will signal a lessening in the extreme demand-pull on global producers and on shipping resources. The global supply chain will feel less strain from demand even as the supply side is picking up. The increased amount of Total Container Traffic coming through our five busiest ports is a solid indication that supply is already improving. Expect more gains ahead.

Companies should heed the rate-of-change and leading indicators for China and our forecast for global deceleration in 2022 and adjust growth expectations accordingly. A positively correlated company can expect growth in 2022, but at a decelerating pace. Budgets, production expectations, inventory levels, and cash flow projections should be considered with decelerating growth in mind. You can find out if you are positively correlated to the economy by going to our website and using DataCast™ for the free trial period. In minutes you will know how you fit into the economy and how you should start planning for 2022.

Alan Beaulieu

President