China has tentatively entered Phase C, Slowing Growth.

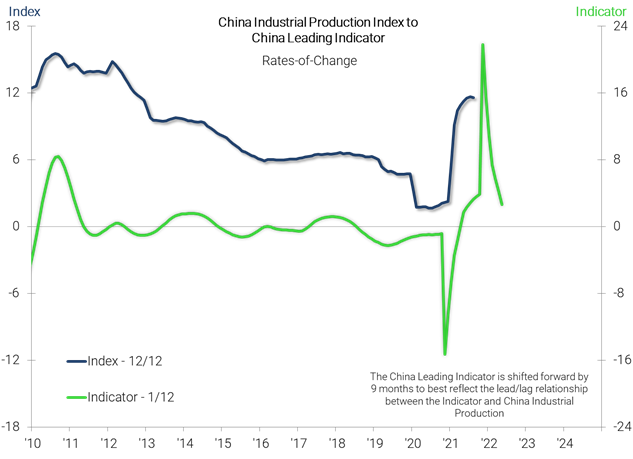

China’s annual growth rate has tentatively transitioned to the back side of the business cycle. Annual Industrial Production is growing at a slowing rate. Quarterly Industrial Production has been in Phase C, Slowing Growth, since April, and the 3/12 rate-of-change is below the 12/12 rate-of-change; these ITR Checking Points™ suggest we will see further descent in China’s annual growth rate.

Both the China Leading Indicator and the Major Five Asia Leading Indicator are offering clear signals that the nascent decline in China’s annual growth rate is sustainable. Within China, Electricity Production and Railway Freight Carried are singing the same tune: the robust rise that carried China through the first half of 2021 has reached its zenith.

What does this mean?

It means that China’s economy will be heading back toward the growth rates we saw in the three years preceding the global pandemic. We do not anticipate a recession will occur in Industrial Production during the next few years. While Phase C, Slowing Growth, would typically mean you could expect some easing in supply chain constraints, the backlogs, the ongoing global demand, and the nature of the global pandemic’s impact on supply chains suggest your supply chains will likely remain strained for the near term.

Politics have the potential to exacerbate the situation. President Xi’s views on private enterprise, if acted upon, will disrupt the status quo. With political change there are bound to be winners and losers. Expect that, in at least the short term, your supply chain will not be in the "winner" category.

A slowing rate of growth in China is a warning to adjust your growth expectations for 2022, whether you source from China or elsewhere, if you are positively correlated to the Chinese economy. Our plethora of leading indicators are signaling that decelerating rise will be the norm in most countries in 2022. Compare your rates-of-change to extant leading indicators to see how that deceleration will likely impact your budgets and your decisions as we prep for 2022.

Jackie Greene

Vice President, Economics