In my most recent ITR webinar, Construction Trends 2021, I discussed the divergence between residential and nonresidential construction markets in 2020 and posited that decline in nonresidential will persist in 2021 as housing continues to rise. In the weeks since I presented that webinar, these trends have become even more apparent.

Housing construction is red hot. The ascent is driven by multiple favorable factors, including low interest rates, insufficient existing home inventory, and COVID-19 related demographic shifts that are allowing some buyers to uproot from rentals in high-cost urban hubs in order to buy single-family dwellings in suburban or rural markets. Success in the housing market, a leading sector, bodes well for the US economy at large in 2021. However, residential housing not only leads the US economy but also nonresidential construction as well:

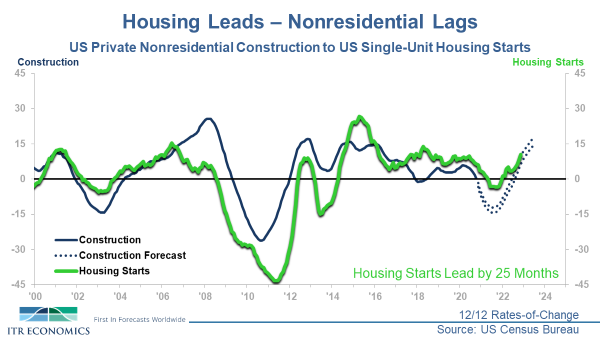

In this representation, we have the US Single-Unit Housing Starts year-over-year growth rate (green line) overlaying the US Nonresidential Construction year-over-year growth rate (blue line). Per our analysis, US Housing Starts lead Nonresidential Construction through the business cycle by 25 months. In other words, we can look at today’s housing market trends to glean insight into where nonresidential construction is going during the next two years.

Armed with this information, we have good news and bad news; the good is that the robust housing market trends (which we expect to continue in 2021) portend future rise in Nonresidential Construction markets in 2022 and 2023. The bad news is that prior decline in the housing market suggests more turbulent times ahead in 2021 for Nonresidential Construction before we get to those greener pastures in 2022.

This would be a typical, delayed response to macroeconomic decline in the macroeconomy in a "normal" recession. This cycle, some obvious markets such as commercial office space, hospitality, and brick-and-mortar retail construction are likely to be more adversely affected than others. In my webinar, we will discuss the potential winners and losers in the overall market, and we will cover Management Objectives™ that may bear fruit for those companies likely to face a more challenging selling environment in 2021.

Connor Lokar

Senior Forecaster