It is time for a consumer check-up. As of now:

- The US Consumer Credit Card Delinquency Rate is at 2.53%, up 105 basis points from a 2Q21 low.

- The US Consumer Loan Delinquency Rate is at 2.20%, up 75 basis points from a 2Q21 low.

- When adjusted for inflation, the consumer savings balance for the US is down 5.7% from a 1Q21 record high.

Diagnosis

- The Delinquency data is moving in the wrong direction (upward), though the magnitude is not particularly notable (Delinquency Rates were significantly higher in the months leading up to the Great Recession). The Delinquency numbers are noteworthy in their trend but are not immediately problematic.

- The savings trend is also moving in the wrong direction (downward). However, we are still flush with cash.

Bank Influence

Banks are tightening lending standards. This trend is going to make any squeeze on retail sales that eventually stems from rising Delinquencies and declining savings more pronounced.

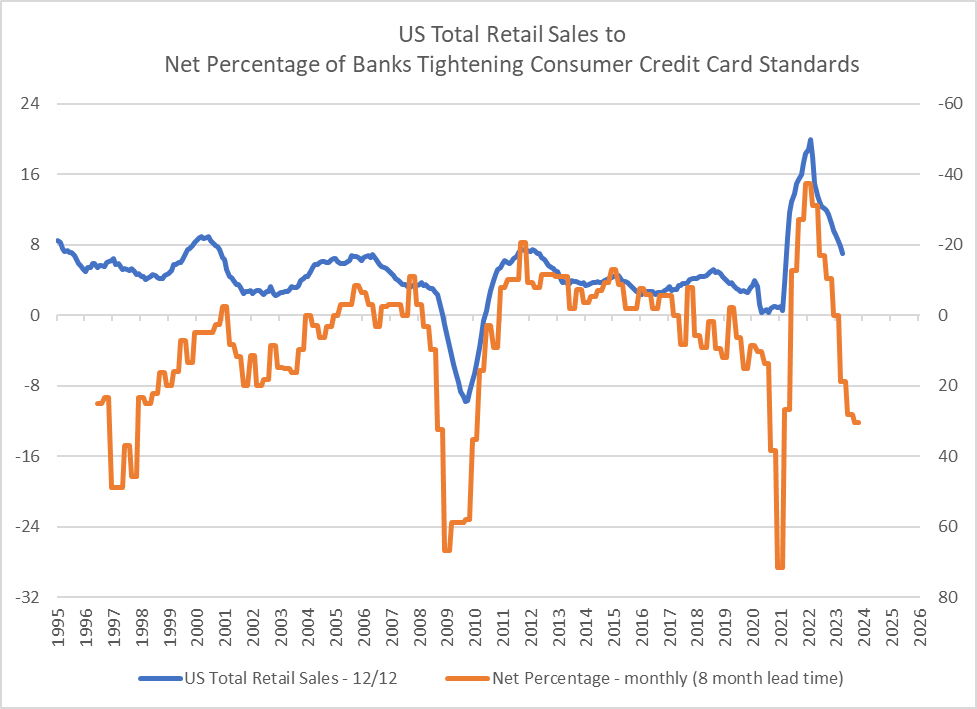

The tightening trend is evident in data from the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices:

- As of March (latest data), the Net Percentage of Responding Domestic Banks Tightening Their Standards for Approving Credit Card Applications was at 30.4%. That is abnormally high and is usually indicative of a pending problem in the economy.

- Domestic banks began shifting toward favoring tighter lending practices in 3Q21 as profitability in the banking sector was weakening. The profit trend peaked in 4Q21, before the Federal Reserve started raising interest rates (March 2022).

Economic Consequence

Consumer credit troubles – whether difficulty making payments on existing credit cards or meeting the heightened standards to access new credit – will typically adversely impact US Total Retail Sales, which then have a direct bearing on the trend for US GDP.

- The Net Percentage trend is inverted in the chart because tighter credit approval standards mean more downside pressure for Retail Sales.

- The Net Percentage trend is also shifted forward by eight months along the horizontal axis because changes in credit standards precede changes in consumer retail activity.

What This Means

- The Net Percentage trend does not bode well for Retail Sales for at least the next few quarters.

- The status depicted by the chart affirms our outlook of a US recession in 2024.

For the latest insights on the consumer, the economy, and what it means for your business, keep following ITR Economics.