The dust is settling from the double black swan events of early 2020, and we are examining the economic data to reveal the extent of the impact. Early signs are showing a sizeable disruption to the business cycle, as we have discussed in recent months.

Due to the nature of the pandemic, we economists are finding ourselves tracking new and unusual types of data, such as new COVID-19 cases and deaths. We are adjusting our analysis as we learn and adapt to the idiosyncrasies of these novel data points. For example, numbers of new COVID-19 cases may initially appear to be an important signal of disease proliferation. However, differences across geography and time in the criteria for and availability of COVID testing renders the cases data vulnerable to variability.

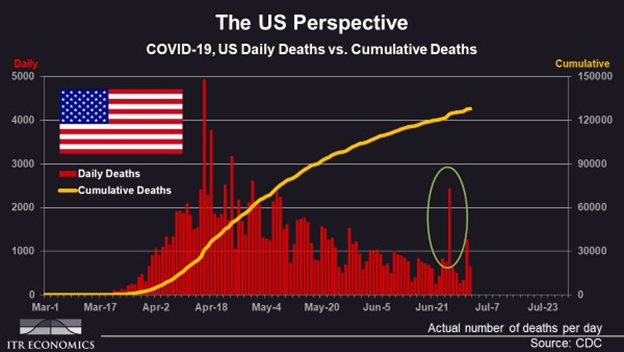

Alternatively, we can turn to daily COVID deaths as a more reliable indicator. Yet even this seemingly unbiased indicator is not immune from data inconsistencies. Roughly a week ago, the data on US COVID-19 deaths showed a sharp, one-day spike, circled below in green.

When coupled with frenzied news reports of a potential second wave, this single data point could have sparked greater concerns. Yet this spike was in fact caused by a tabulation change in a single state. Following analysis of death certificates and timing, New Jersey health officials reclassified 1,854 previous deaths as "probable" COVID-19 fatalities, and they were added to the state’s count for one day. State-level data on this subject are not consistent, with some states requiring a definitive lab test to classify a death as COVID-related, while others accept clinical judgment. There are additional data irregularities on a weekly basis due to reporting errors, with Monday death totals consistently low and Wednesday totals consistently high.

We are not yet at the bottom of the business cycle, and future data releases – both for COVID cases and deaths, as well as for more traditional economic indicators – are likely to exhibit some negativity. Don’t allow yourself to get caught in the weeds of each release. Instead, focus on the long game. Data points may be volatile, but your management should not be. Cut through the noise, using rates-of-change and a “big picture” viewpoint, to direct your decision-making.

Lauren Saidel-Baker

Economist