According to the US Census Bureau data, the Total Retail Sales 12-month moving total (12MMT) posted a 3.2% increase over the same period last year. US Retail Sales have continued their upward trajectory through the first four months of 2025 despite uncertainty and the headlines, reflecting both resilience and evolving consumer behavior.

Key Essential Categories: Stabilization, Not Acceleration

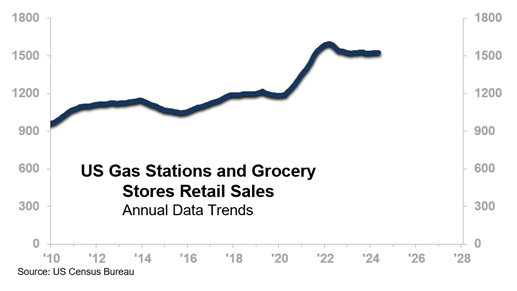

Gas Stations

One of the few categories showing outright decline, gas station sales posted a 3.5% year-over-year decline and were 15.2% below the early-2023 record high. This drop aligns with lower gasoline prices over the same period.

Grocery Stores

Grocery store sales rose 2.5% from a year earlier. The growth is modest, and it is expected given population growth, inflation (sales are in nominal dollars), and the essential nature of food.

Flat Spending Trend Since Early 2023

When combining gas station and grocery store spending and tracking the trend over time, total spending in these two core categories has been essentially flat since early 2023. This suggests that recent retail growth is being driven elsewhere.

Discretionary Spending Gains Momentum

Food and Beverage Services

Food is essential, but dining out and ordering in via food delivery services is less so. Nevertheless, consumers are spending more in this category. Sales at food and drinking establishments are up 4.5% year-over-year.

Clothing Stores

Apparel spending has continued along its long-term upward trajectory, rising 2.8% relative to the year-ago level.

Mixed – Discretionary and Non-Discretionary

Health and Personal Care

Sales at health and personal care stores increased 4.6%, underscoring continued consumer interest in wellness-related categories and appearances.

The data illustrates a nuanced picture of US retail in 2025:

- Spending in essential categories like groceries and fuel has been stable. With consumer spending across these sectors combined, the trend is flat since early 2023; topline growth here has been relatively limited.

- Meanwhile, discretionary categories such as dining out and apparel are showing significant year-over-year gains, driven by consumer preferences and behavior.

Businesses should take note of the momentum in non-essentials. It shows that, despite the headwinds of high interest rates and cumulative inflation, as well as the ominous headlines amid tariff-related uncertainty, consumers are still willing to spend beyond the basics.