- Credit card debt balances are going to rise further.

- The credit card delinquency rate is also set to go higher.

- The two trends may hinder retail sales ascent because of the high interest rates on that debt.

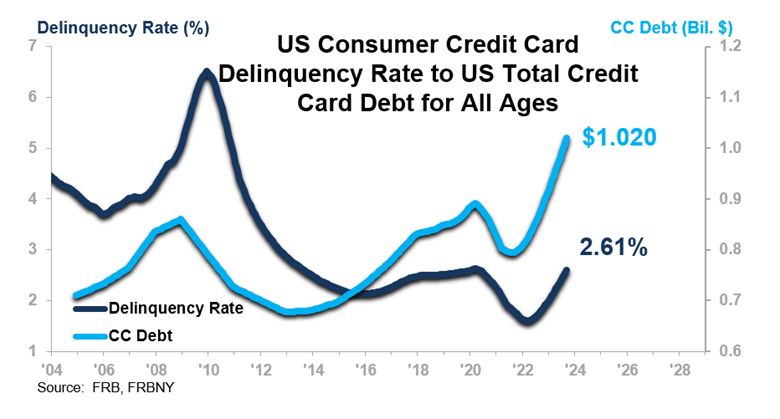

The chart below shows that balances and delinquencies are rising. Individuals have been taking on debt faster than incomes are rising. Credit card balances have risen by $216 billion since the fourth quarter of 2021. That is an increase of 28% since the end of 2021. Total Personal Income (nominal dollars) on an annualized basis rose 9.4% through that same time.

Record-High Balances

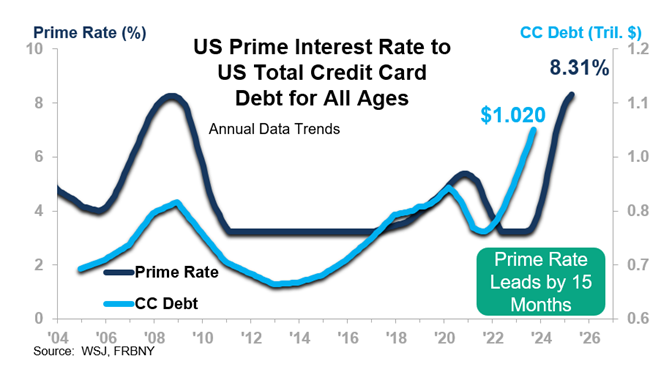

Expect to hear more about rising credit card balances going forward. The chart below shows that rise in interest rates, as represented by the prime rate, is a 15-month precursor of the credit card balance trend. Concern over the high balance is understandable given the last two times we established record highs were in association with the Great Recession and right before the COVID-induced recession. Credit card balances will rise throughout 2024.

Our analysis indicates that the high credit card balances are not causal to business cycle decline, but high balances leave the consumer ill-equipped to deal with financial stresses stemming from the cyclical decline. ITR Economics is projecting that the current business cycle is going to be nothing like the Great Recession in severity or duration. The anticipated mildness of this cycle mitigates against the concern of the consumer being ill-equipped for adversity.

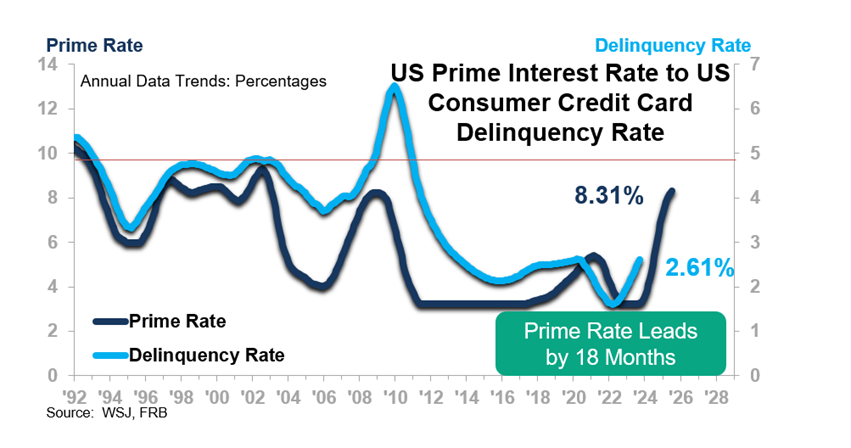

Rising Delinquency Rates Are More of an Issue

We are not concerned about the rising card balances because they are not causal as stated above. However, rising delinquency rates are more telling regarding a general economic threat.

As shown by the chart below, the current delinquency rate is 2.61% and rising. As was true for the balances, the trend in the prime rate leads the delinquency rate, in this case by 18 months. The current rate of delinquency is barely within the range of normal and is below any rate over the last 30+ years. History suggests that there is no threat to the overall economy until the delinquency rate approaches/exceeds the upper boundary of normal, which is 4.89%.

The magnitude of the change to date in the prime rate does not bode well for the rate staying on the safe side of 4.89%. ITR Economics will be watching this trend closely.

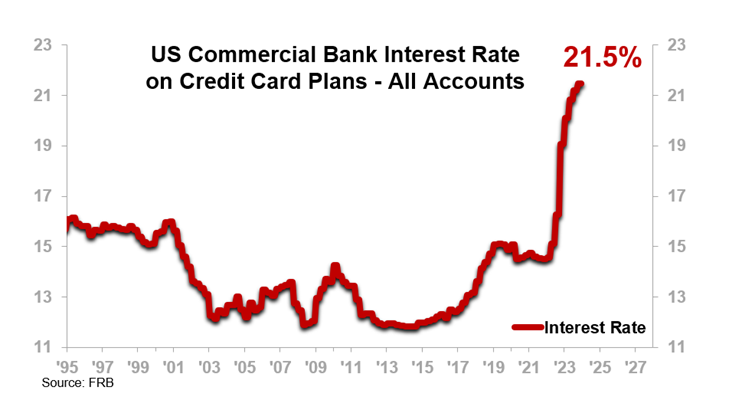

An Added Level of Concern

Large balances with high credit card rates will lead to even more upside pressure on the delinquency rate. The chart below shows that the meteoric rise in rates puts us in territory not experienced in the last 30 years.

Overall, the national average card debt among cardholders with unpaid balances in the third quarter of 2023 was $6,993. That includes debt from bank cards and retail credit cards. Servicing that debt at 15% is onerous enough; at over 21%, keeping up with payments just became that much more difficult for many people.

Putting It All Together: There May Be a Counterbalance

A key to minimizing or even avoiding the dangers suggested above is the Federal Reserve lowering interest rates sooner rather than later and making significant moves downward. That is not what they are indicating. It could be the Fed is balancing the above potential threat with the strong employment trends currently evident; prior cyclical declines of consequence typically have more labor distress associated with them. We are not anticipating that level of stress in 2024.

ITR Economics’ weekly Fed Watch on YouTube. The 3- to 7-minute update is posted every Friday afternoon.