As we progress through 2025, US consumers are experiencing a varied landscape in automobile-related transportation costs. While trends in certain expenses, such as fuel and used vehicle prices, indicate a measure of relief, others, including maintenance and insurance, continue to exert financial pressure.

Fuel Prices: National Declines

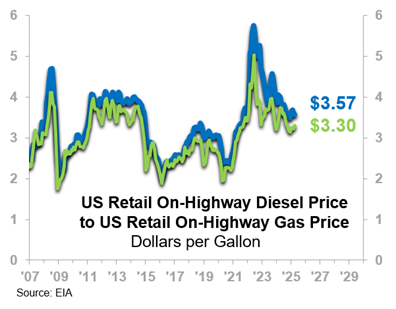

Nationally, fuel prices have seen a decline. As of April 2025, the US Retail On-Highway Gas Price averaged $3.30 per gallon, and diesel averaged $3.57 per gallon, both reflecting decreases from their peaks in 2022, of 34.5% and 38.0%, respectively.

New Vehicle Prices: Stabilization at Elevated Levels

After a significant and protracted COVID-era ramp-up that lasted through year-end 2023, new vehicle prices have largely plateaued. The 12-month moving average (12MMA) is down slightly (0.7%) from an early-2024 record high.

Despite this stabilization, prices remain elevated. Over the last five years, new vehicle prices have risen 21.2%.

It is worth noting that this increase is about on par with rise in the overall US Consumer Price Index over that time.

Used Vehicle Prices: Down From COVID-Era Highs

Used Vehicle Prices: Down From COVID-Era Highs

Used vehicle prices have shown relative stability. As of April, the Consumer Price Index for Used Cars and Trucks was down a 13.3% from its late-2022 COVID-era record high. The declining trend has ended; annual average prices have been trending relatively flat in recent months, and the 12/12 rate-of-change is moving upward.

As with new cars, used car prices are elevated on a historical basis, up a cumulative 29.5% over the last five years.

A Cumulative Burden

A Cumulative Burden

For used cars, the COVID-era price ramp-up outstripped the rise in overall Consumer Prices. The more recent stabilization in prices should be evaluated through that lens – yes, there has been a normalization, but the “normal” is a new one. And interest rates – still elevated relative to 2010s levels – are also in “new normal” territory.

Maintenance and Insurance: Ongoing Cost Increases

Consumers would certainly be better off if they were paying for just cars and fuel. Other components of vehicle ownership continue to rise at a faster pace. Unlike new and used car prices, the CPI for motor vehicle maintenance and repair has not exhibited any post-COVID-era normalization and is up 38.2% over the last five years amid a tight labor market (with upward pressure on wages) and increased parts costs.

Motor vehicle insurance costs, meanwhile, are up 54.5% over the last five years, due in part to both the higher cost of vehicles and the higher cost of repairs.

How We’re Holding Up

Clearly, motor vehicle ownership and use incur major costs for the consumer, and the burden is higher – even accounting for the inevitable progression of overall inflation – than during the pre-COVID decade. The Auto Loan Delinquency Rate is not far below the historical peaks established during the Great Recession and COVID eras, and it is rising.

Fortunately, macro consumer metrics remain strong. Real Personal Income is on trend with its long-term historical rise. Despite the ramp-up in auto loan delinquencies, overall consumer debt appears manageable, with Debt Service Payments as a Percentage of Disposable Personal Income trending below longer-term norms.

We have been describing the consumer status as “bending but not breaking” for at least a couple years now. That descriptor still fits.