We have all read and heard the media proclamations over the last decade or more regarding the ascendance of electric and hybrid vehicles. Now that the ascendance is showing in the data, we can believe it.

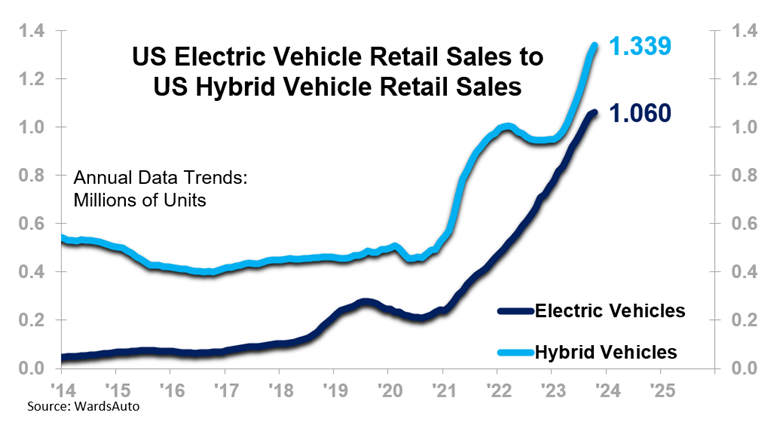

Both US Electric Vehicle Retail Sales and US Hybrid Vehicle Retail Sales have risen markedly since the COVID shutdowns turned the US economy upside down in early 2020.

- At 1.06 million vehicles as of October, the US Electric Vehicle Retail Sales 12-month moving total (12MMT) is up 353.6% relative to the pre-COVID shutdowns level (i.e., the February 2020 level).

- The US Hybrid Vehicle Retail Sales 12MMT, at 1.34 million vehicles as of October, is up 163.0% from before the shutdowns.

The steep rise in sales of electric and hybrid vehicles since COVID is clearly visible in the chart:

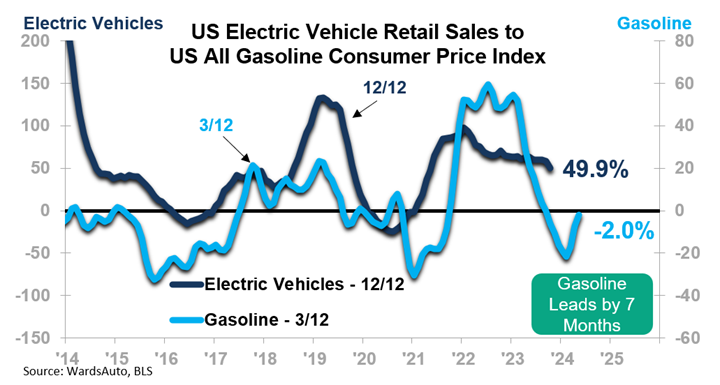

These already impressive figures are all the more noteworthy when we use a proper basis for comparison:

- The US Internal Combustion Engine Vehicles Retail Sales 12MMT in October was down 5% from the pre-COVID level.

- Just before the COVID shutdowns, hybrid vehicles and electric vehicles comprised 4.4% of the total (internal combustion, hybrid, and electric); as of October 2023, that share had increased to 15.8%.

- Some may attribute this shift in dynamic to government regulation and incentives as well as a general society-wide movement toward cleaner energy. These surely are key factors. But car buyers are also practical, as the following chart shows. When gasoline inflation (depicted by the US All Gasoline Consumer Price Index quarterly rate-of-change) rises, it positively impacts the electric vehicle industry (US Electric Vehicle Retail Sales annual rate-of-change).

Trends are shifting in the motor vehicle market, and you should be prepared. For a more comprehensive look, including our full forecast for the industry, see ITR Economist Derek Stanley’s November webinar: Auto Market Update: The Road Forward. The one-hour webinar is available to ITR Economics Insider™ subscribers.