Things are changing in China, and, based on the four trends presented below, these changes are not for the better. China’s growth beginning in the 1970s was truly impressive as the country served as a low-cost manufacturing floor to the world. The impressive growth rate is a thing of the past.

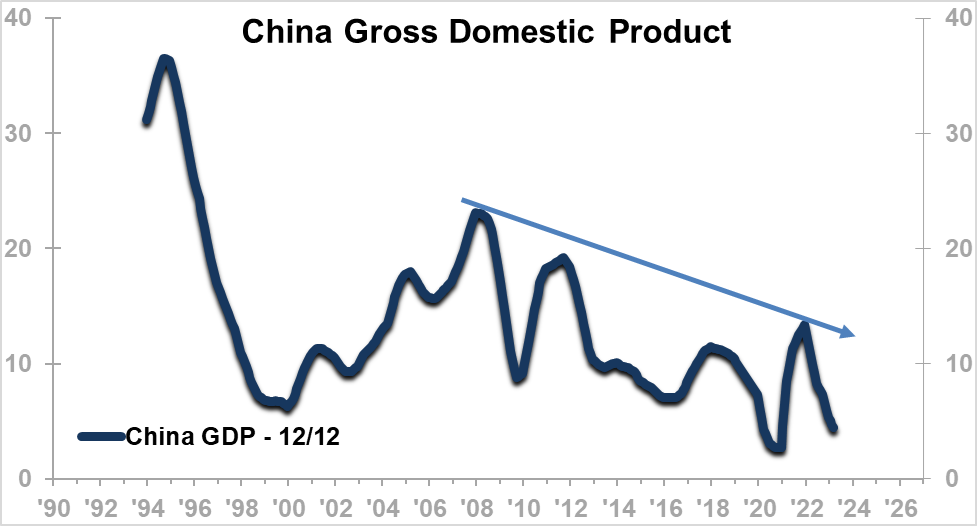

1. Gross Domestic Product

The chart below shows the decline in the GDP rate of growth off the December 2007 11.5-year high of 23.1%. The general decline over the last 15+ years does not in and of itself suggest that deceleration and potential stagnation in economic growth must occur. However, the next three trends suggest that China’s peak growth years are in the past and a more difficult economic future awaits the world’s second-largest economy.

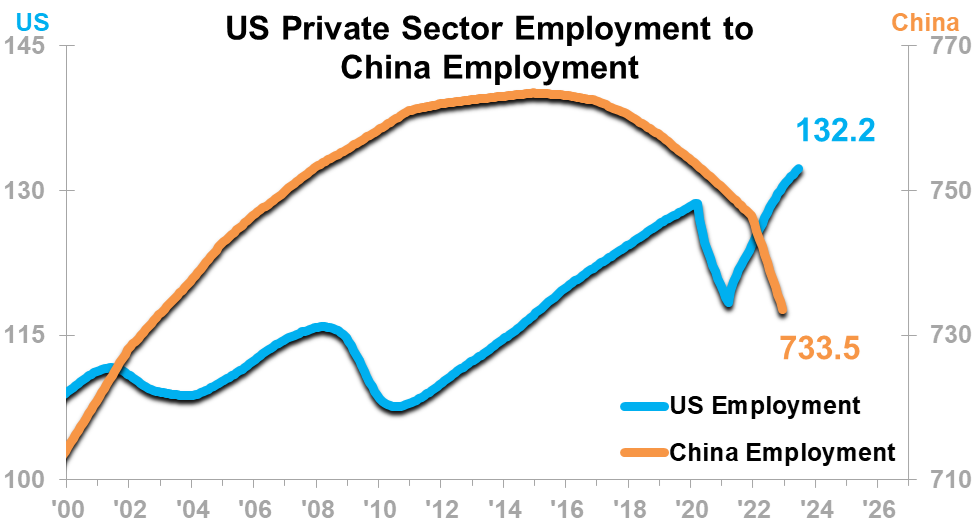

2. Employment and Population

The number of people working in China reached a peak approximately 20 years ago, in 2014 (see the chart below). The availability of low-cost labor was a key to China’s growth. The diminishing supply of labor is accompanied by rapidly rising labor costs. The average annual wage as of December 2022 (latest available data) is 9.502 thousand CNY, a little over twice the annual wage in December 2014. The US experienced a 33.7% increase in the median annual wage through the same period. Increased costs are a pressure point in China and make other countries look more attractive as manufacturing bases. Overall economic expansion becomes more difficult in a nation with a population in decline.

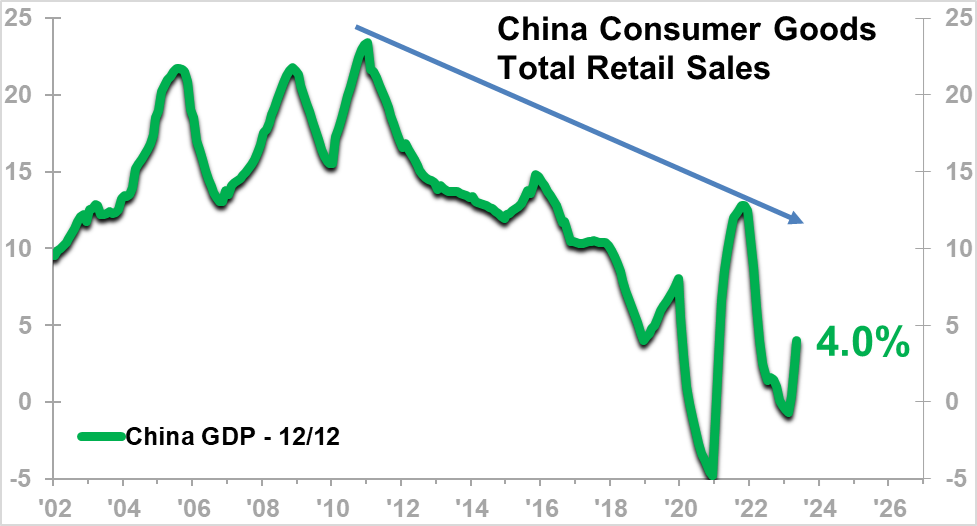

3. Domestic Consumption

The rate of growth in China Consumer Goods Total Retail Sales established a record high in January 2011. The steady decline since then was interrupted by COVID, but there now appears to be a return to the longer-term trend. A continuation of the decelerating rise in Consumer Goods Total Retail Sales will contribute to slower growth in China’s GDP.

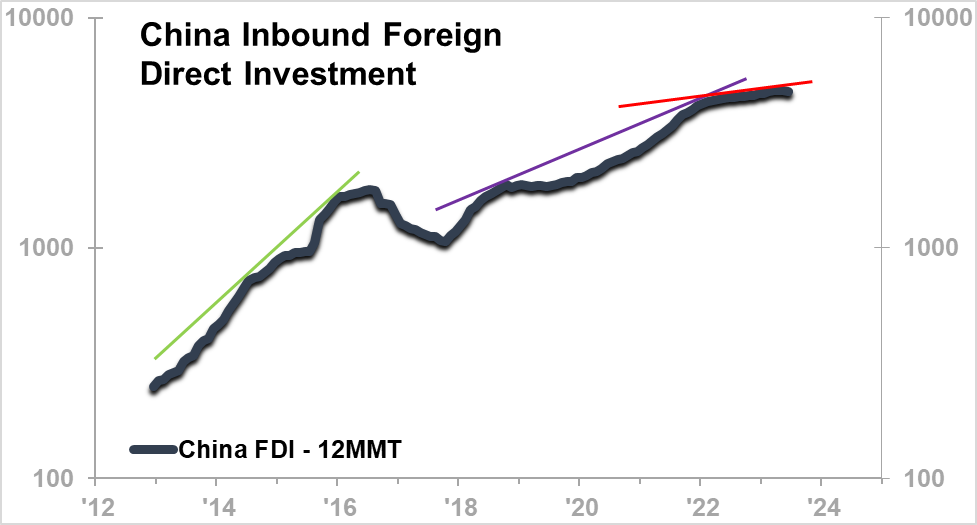

4. Foreign Direct Investment Utilization

Foreign Direct Investment into China is the net deployment of funds by businesses into China. The chart below shows that the robust growth through mid-2016 was followed by a milder rate of rise from late 2017 into very early 2022, when there was another shift into a more noticeable slowing in the Foreign Direct Investment into China. The change to a flat-to-mildly-rising trend in Foreign Direct Investment into China signals a decline in confidence in the economy.

Indeed, according to a European Chamber Survey, 1 in 10 companies have shifted investments out of China and another 1 in 5 are considering the same path. Numerous reasons are offered, including geopolitical risk, government protection for domestic competitors, spying, and a heavy-handed government (think Jack Ma). Troubles in China equate to new opportunities in other countries, including Vietnam, India, Malaysia, Indonesia, Mexico, Eastern European countries, and the US.

What This Means

Doing business in China is changing, and the underlying factors suggest that China’s growth rate, and eventually its importance in the global economy, will slowly dissipate. New business opportunities will grow in other countries, which will provide agile and entrepreneurially minded businesses with increased opportunities. As with all that we do at ITR, the importance will be on thinking in terms of measurable changes ahead and avoiding the easier “steady as she goes” mindset.

ITR Economics is here to guide your business into the future by identifying and measuring future changes in countries, industries, and companies. We help you skate to where the puck is going, not to where it has been.