US single-family residential markets are in a slowing growth trend. Yes, anyone attempting to purchase a home right now may dispute this, as high prices and extremely tight inventory continue to plague would-be homebuyers nationwide. However, as far as new construction and sales are concerned, the single-family home market is on the back side of the business cycle, and it is giving us a preview of what is to come from a macroeconomic perspective as 2022 wears on.

The single-family market has proven to be a historically relevant leading indicator for the overall US economy. It not only comprises a significant portion of the economy but is also reflective of consumer health. The housing market relates to the consumer’s ability and willingness to spend, not just on homes but also on all the adjacent goods that support home ownership; these include furniture, consumer electronics, appliances, building materials, and more. It therefore makes perfect sense that the housing market has been one of the first sectors to show signs of slowing growth while other more coincident or lagging indicators continue to push upward in Phase B, Accelerating Growth.

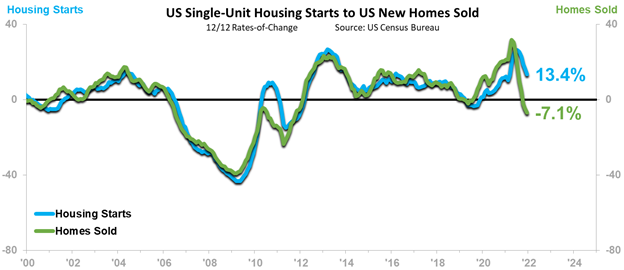

Robust single-family housing construction activity characterized the majority of the last two years, with US Single-Unit Housing Starts expanding 11.6% in 2020 and another 13.4% in 2021 on a year-over-year basis. However, recent momentum to kick off 2022 has been decidedly weaker, as Starts during the final quarter of 2021 fell 5.5% compared to the prior year. ITR Economics expects that Single-Unit Housing Starts will expand a more modest 4.3% in 2022 (our complete three-year forecast is published in the ITR Trends Report™). It is worth pausing to reinforce that the +4.3% growth expectation for 2022 is exactly that – growth! We are not anticipating a Great Recession-like downturn for the housing market in 2022. Inventory levels are still exceptionally low, which should serve as a backbone of sorts for this particular cycle, yielding slower growth but not the absence of it.

This less-robust growth in 2022 reflects what we expect to be a more strained consumer environment this year; the general US consumer will be grappling with high inflationary pressures (in both home and general consumer goods prices), rising interest and mortgage rates, and savings and disposable income levels that are normalizing after the stimulus-induced elevation during 2020 and 2021. We are already seeing these trends pressuring New Homes Sold volume, which is down 7.1% year-over-year:

Our clients that are tied tightly to residential construction activity have been hearing the warnings from us about this forthcoming 2022 market slowdown for some time now, and they have been seeing the expected impact in their ITR Economics-generated forecasts. However, even if you are not directly tied to residential markets, this early slowdown is worth monitoring, as a softening consumer environment will eventually impact businesses of nearly all stripes as 2022 wears on.

Businesses with more direct exposure to housing should evaluate their 2022 plan. Make sure your 2022 outlooks are not characterized by undue positivity; they should reflect a more sober growth expectation relative to the last 24 months. Companies that find themselves more removed from the immediate swings in the housing market should note that housing represents a key domino that could trigger cascading impacts to their business later on this year.