Inflation is a hot topic throughout the country and beyond. ITR Economics expects that we will experience a temporary general abatement from today’s inflation levels before upside inflationary pressures return in early 2023.

Assuming our outlook is correct, the Federal Reserve Board has time before inflationary pressures force them to raise interest rates later next year or in 2023, which gives business leaders time to take advantage of today’s exceptionally low borrowing costs. This is the perfect time to borrow money and invest in your business, preferably in areas of automation and other efficiencies that will reduce or at least hold the line on costs throughout the company as we move into an inflationary environment that will extend for years to come. Today’s efficiency gains will result in tomorrow’s profits and an enhanced competitive position, especially in a tight labor market which we are forecasting will last for years.

Inflation Is Uncomfortably High

The Consumer Price Index for Urban Areas rose to 6.2% in October, the highest level in just under 31 years. This is obviously more inflation than many people in the workforce have had to contend with. Businesses and individuals alike are feeling the impact in many areas. Core inflation, without food and energy, stands at 4.6%, the highest in just over 30 years. The CPI for Energy has soared, reflecting a 30.0% rate of inflation, the highest in 16 years. Food is up 5.3%, the highest in 12 3/4 years. Housing costs are up 4.5%, the highest rate of inflation in just over 20 years. No wonder inflation is top of mind for businesses and individuals alike.

It is natural and easy to assume inflationary pressures will remain high. Brian and I discovered many years ago when we wrote our first book, Make Your Move, that people naturally tend to be straight-line forecasters. It would be a mistake to straight-line forecast today’s inflation pressures, as that could lead to locking in costs on the belief that material and various other costs are going to continue escalating at today’s rates. For instance, it would be costly for a business to lock in a six-month supply of copper at $4.40 per pound on the belief that price rise is a fact of life, only to discover that prices decline $0.12 from March to December 2022.

The Rate of Inflation Will Temporarily Abate

It is easy to find an article or commentator suggesting that inflation will continue at today’s rate, or greater, in the months to come. Many people think we are reliving the late 1970s and early 1980s. We do not agree with that outlook.

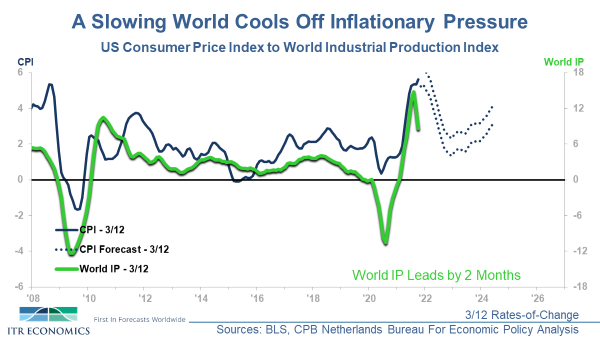

ITR Economics uses rates-of-change, leading indicators, and our unique cyclical theories to guide our forecasts (see our website for more free information on rates-of-change, the four phases of the business cycle, leading indicators, and how to incorporate these tools into your business). There are a number of key leading indicators that show inflation will ease in the near term. One such leading indicator is shown below.

The above chart compares World Industrial Production to the Consumer Price Index for Urban Areas (both 3/12 rates-of-change). The World Industrial Production 3/12 (the green line) is in decline, indicating that the Consumer Price Index (the blue line) will soon reach a high and begin to move lower. Numerous leading indicators, including the ITR Leading Indicator™, signal ongoing descent in the World Industrial Production 3/12. The 3/12 trend signifies that the demand aspect of the global economy is normalizing. Logic suggests more decline in World Industrial Production’s growth rate given the current slowdown in China, the world’s second-largest economy. There are also over 11 extant leading indicators signaling a slowing rate of rise in the US and around the world in 2022, which translates to more decline in the green line shown above. That in turn is a clear indication that the CPI trend line will also reverse direction and decline toward the zero line. The dotted line on the chart illustrates the disinflation we are projecting.

And Then Inflation Returns

The abatement in inflationary pressures is temporary, as stated above. We are projecting that inflation will slowly increase beginning in early 2023, with inflationary pressure gaining momentum through the year and in 2024. The resumption of inflation is signaled by ITR’s proprietary cyclical theories. The outlook is also fueled by ascending labor costs and the ongoing increase in the US federal debt, which has a tendency to decrease the value of the US dollar. Higher production costs and a weaker dollar can be expected to reignite inflationary pressures.

Action Items

Business leaders should consider the following action items given our outlook:

-

- Borrow and invest in your business as described above.

- Invest in real estate as a way to take advantage of low-cost interest rates and future price escalation, including rental rate increases. Real estate in the right location is a worthwhile hedge against inflation.

- Invest in areas of the economy that do well in periods of inflation. Talk to your wealth advisor or email me at alan@itreconomics.com to learn more on how to use the ITR Equity Optimizer™ to your advantage in this interim period and as we prepare for an inflationary environment.

- Talk to those in the company who have experienced inflationary periods. Talk to them about what worked and what did not work in the past. This tribal knowledge can provide a framework of experience for future decisions.

Alan Beaulieu

President