Our view toward where inflation is heading clearly indicates the Federal Reserve could stop raising the fed funds rate immediately if they wanted to despite the very low unemployment rate. To strive for both low inflation and higher unemployment is to run the risk of turning what should be a mild 2024 recession into a more painful and potentially longer decline. Here is what we are seeing on the inflation front:

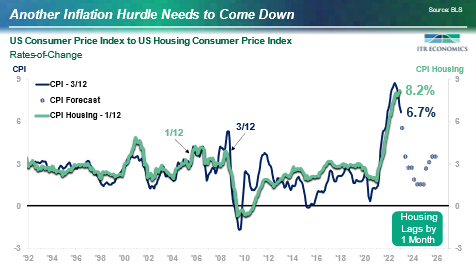

1. Inflation is coming down. The road signs regarding ongoing disinflation are increasing in number. The only real holdout is the CPI Housing component. That is not a surprise. This part of the CPI is slow to depict disinflation. But we can see in real time that home prices are coming down (not to pre-COVID levels) or are not going up nearly as much as they were in the still-hot markets. Rents are following suit. All of that means today’s CPI reading of 8.2% will be coming down and, with that, the last vestige of stickiness of the high inflation rate.

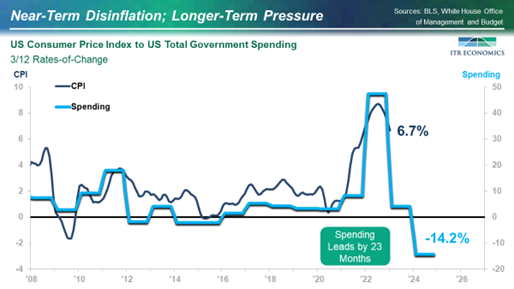

2. The extended inflation outlook is benign through 2024. Our long-term indicator for inflation is whether government spending is increasing year-over-year or decreasing. Notice how the CPI inflation rate peaked within the bracket depicted by this indicator. The current reading is -14.2% because the COVID-inspired level of spending is no longer occurring. Adjusted for the two-year lead time, that means we should be relatively unconcerned about inflation rearing its head again until we are beyond 2024. Don’t expect the CPI trend line to go as low as it normally does for a cyclical low because of food, diesel fuel, and some other issues. We are projecting that inflation for 2023 will be 3.6% (forecast average) come the end of the year. That should be low enough to see “core inflation” at the Fed’s threshold for easing interest rates.

3. We are under no delusions about the spending signal shown above staying down. You need only remember the dollars involved in the infrastructure bill and the “anti-inflation” bill to know that the trend will be back above zero. How elevated above zero will likely be something more readily gauged after the debt ceiling negotiations are concluded. Inflation will be back. We continue to see it as a defining problem for the second half of this decade.