The difference between trends in Cold Rolled Steel and Steel Scrap prices caught our eye. At first, we thought that it would be a consequence of US tariffs. This may be the cause; or, it could be China interfering in their own economy. Either way, someone will have to pick up the tab.

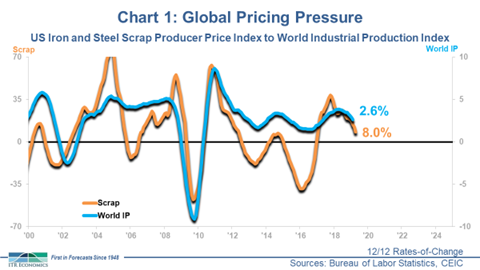

Delving further into the steel question, there are not many instances of the US putting tariffs on steel during the post-WWI period. Besides the current administration's tariffs, there was President George W. Bush's 2002 tariff on steel. The two instances turned out to be considerably different because of the US/global business cycle. In 2002, the business cycle was in the early stages of ascent. As the chart below shows, it was (and still is) normal for prices to rise in concert with the business cycle. The magnitude of the ascent in prices in 2002, as evidenced by the brown rate-of-change trend, appears to be super-sized, perhaps because tariffs of up to 30% on imported steel, but that is not easy to prove. The chart below also shows that the Steel Scrap PPI is in a disinflationary trend because of the global (and US) business cycle. That is what is expected under market conditions, and that is what is happening.

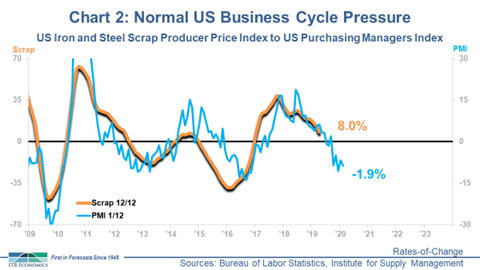

The next chart shows the US ISM PMI (Purchasing Managers Index), run through our 1/12 rate-of-change, and the PMI’s attendant functionality as a leading indicator to the PPI. The leading Indicator trend is clearly saying that further disinflation in the PPI is probable based on what has already happened in the PMI 1/12 rate-of-change.

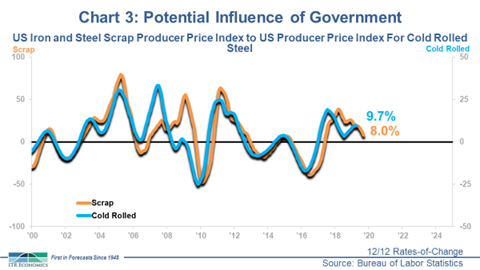

The last chart compares the Steel Scrap PPI cycle to the 12/12 for the US Cold Rolled Steel PPI. The two measures will typically move in concert, displaying a high degree of cyclical identity. Note that the Cold Rolled PPI recently broke away from the Steel Scrap disinflation trend. Potential reasons are either the US tariffs' interfering with normal market pricing or China’s increased efforts to accelerate its economy.

This is not the first time a disparity presented itself. We saw a very out-sized rise in Cold Rolled in 2006-2007 relative to Steel Scrap. The US Primary Metals Leading Indicator forewarned of that occurrence; that is not happening today. That leading indicator is currently declining, suggesting that an easing in Cold Rolled Steel prices is probable. Exchange rates and China Apparent Steel Use were trends consistent with the exaggerated rise in Cold Rolled in 2016-2017. Exchange rates do not explain the current situation. This leaves us with consumption in China, which is high (Phase B). The Chinese government is stimulating the economy, partly because of normal business cycle activity and partly to counter the trade issues with the US. Either the government’s effort has stimulated consumption of household appliances or inventory is otherwise being built, because appliance production is rising in China right now (as opposed to car production).

Prior experience suggests that the Cold Rolled pricing cycle will resume its normal relationship of inflation and deflation in concert with Steel Scrap prices. The relative price level is expected to normalize with the passage of time if the tariffs are removed or other factors change.

Whether it is our government or China’s, the evidence suggests that there is a price to be paid for interfering with normal market conditions, and it is ultimately the consumers that pay the tab. Public policy theory helps to explain why this occurs. The theory says that small, powerful special interest groups (i.e. the steel industry in the US and the Communist Party in China) seek concentrated advantages/benefits with the costs of those benefits dispersed, not easily visible to the naked eye, and therefore without a strong, united, opposing voice.

All of this simply helps us understand why we are all going to be paying a higher price for at least one business cycle.

Brian Beaulieu

CEO