There are three reasons to see a silver lining in the cyclical slowdown of 2019:

- Interest rates in general will likely level off/decline

- The cost of carrying the national debt will abate in 2019

- Housing affordability will likely temporarily cease to be a growing problem

The US Government 10-Year Bond Yield is easing downward from a potential October 2018 high of 3.14%. December closed at 2.68%, though the rate did edge up to 2.75% in the last week of January. You can see our current forecast for the 10-Year Yield in the February 2019 ITR Trends ReportTM. You will see that we are expecting the trend to be benign in 2019.

Our expectation for a flat trend or mild decline in the Yield in 2019 is consistent with:

- General downside business-cycle pressures in the US

- Weakening inflationary pressures

- The decline in the German 10-Year Bond Yield since February 2018

- The downward trend in corporate profits (a leading indicator)

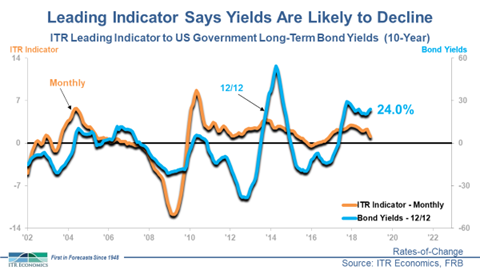

The chart below shows that the ITR Leading IndicatorTM tends to foretell upward and downward cyclical changes in the Bond Yields cycle. The recent leading indicator input is telling us to expect the Yield trend to moderate in 2019. Our forecast for these Yields reflects this input as well as other leading indicator signals.

Ancillary benefits for the economy from a decline in the 10-Year Yield, which would likely help set the stage for better days in 2020, include:

- 30-year mortgage rates will level off or modestly decline in 2019 (which will certainly help the housing market’s woes)

- Since the Federal Reserve traditionally takes a cue from the bond market, the Fed's impetus for raising short-term interest rates via the Federal Funds Rate will moderate/abate

A risk to this outlook stems from potential uncertainties arising from renewed and heightened global trade tensions, which in turn could spark inflationary expectations, which could at least temporarily short-circuit the normal business-cycle process.

Normalcy in 2019 would be wonderful.

Brian Beaulieu

CEO