The combination of extremely stimulative monetary and fiscal policy in the initial pandemic period, followed by the withdrawal of stimulus and interest rate hikes in 2022 and 2023 — all the while with elevated inflation — has contributed to an economy that is not always trending according to historical norms. The cars of the economic train, like housing, industrial activity, and nonresidential construction, are not necessarily moving in their typical order.

A Disconnect Between Housing Trends and Broader Economic Momentum

US Single-Unit Housing Starts, for example, are in a mild recessionary trend, and we expect the trend to persist into early next year. Given the housing market’s status as a leading economic indicator — i.e., one of the early cars on the train — this could typically bode ill for the overall US macroeconomy (industrial, business-to-business, and consumer markets) well into next year. But that is not what we are expecting. In fact, we expect a stronger industrial economy in the year ahead than this year.

Why?

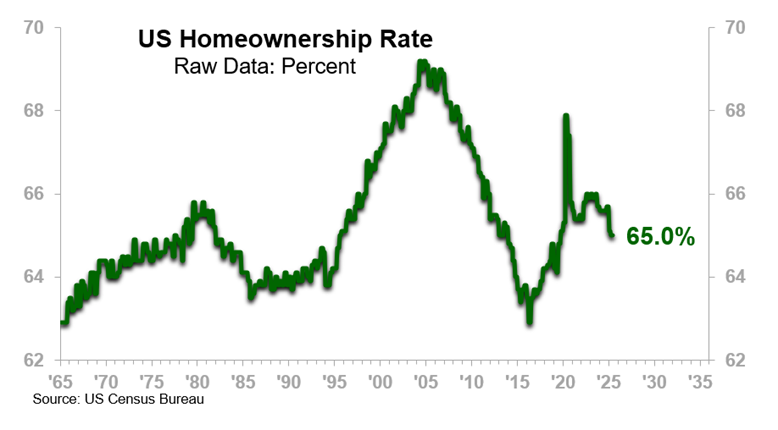

For one, new home construction is just one gauge of consumer health. And it is just one gauge of the housing market. If we look at the US Homeownership Rate — i.e., the percentage of US households that that own the house they live in — it is trending at around 65%, basically dead on the long-term average for a dataset that goes back to the 1960s.

Note that the Homeownership Rate has generally decreased in the last several years from a pandemic-era spike, declining from 67.9% in 2Q20 to 65.0% in 2Q25 (latest available data).

However, at the same time, home values have increased significantly. The US All Residential Median Home Price, published by Redfin, has risen around 50% from pre-pandemic to present. This, coupled with the low average mortgage rate of 4.3% on outstanding mortgages, has created a positive financial situation for homeowners who have benefitted from fixed housing payments and a 27.8% increase in US Median Annual Earnings from 4Q19 to 2Q25 (latest available). The effect is even more profound for those who have stock portfolios and enjoyed the more than 100% increase in equity prices post-pandemic.

The directional trend in the Homeownership Rate is concerning, however, and could factor into the very low levels of consumer confidence, a trend we should note that is a historically poor predictor of consumer spending and economic activity.

Consumers Remain Financially Stable, but Not Equally So

Furthermore, the rising home values (as gauged by sales prices) are a two-sided coin. On the one hand, they indicate a strong increase in equity for at least some homeowners. On the other, however, they are also indicative of the overall inflation that has weighed on some consumers — including those with lower or nonexistent levels of equity — over the last several years. We see this clearly in the credit card data we track, which shows an elevated percentage of consumers making only the minimum payment on their credit card, yet also a much larger contingent who can pay their credit card off in full each month.

In sum, all of this is further evidence of a consumer base of mixed status. Our overall analysis indicates that, on the whole, consumers are “generally financially stable,” as we have been messaging to our clients and in our publications, but not without pockets of stresses and concerns. On balance, we anticipate that the consumer base is healthy enough to drive economic growth, but a good portion of that upward pull will come from those who own homes, enjoy strong portfolios, or earn higher incomes.

For the business owner, this means knowing your clientele and targeting opportunities accordingly. Those in the lower quartiles of the income spectrum may be shopping for lower-priced alternatives; those in the upper quartiles may be relatively less concerned about price and more concerned about getting a product or service that meets their standards.

Do you need more insights about your markets? We're here to help.