Some recent developments in the labor market are, on balance, a positive for the overall economy, even if potentially to the detriment of the employee’s position in the labor market.

Positive Developments for the Economy in General

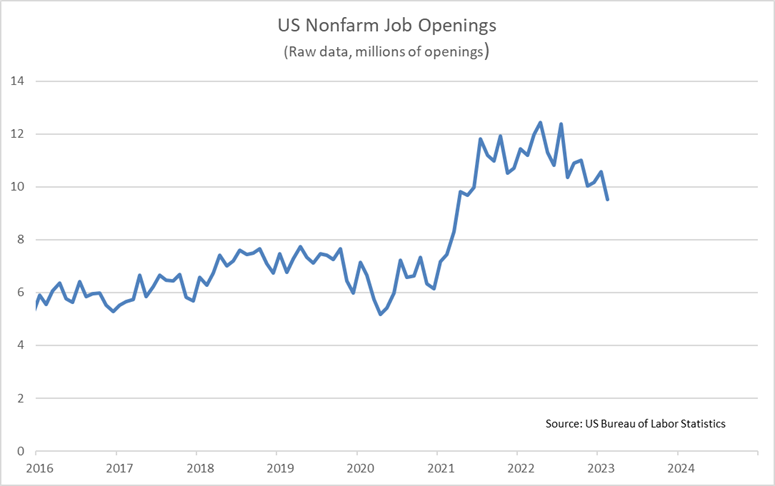

After climbing steeply post-COVID shutdowns, US Nonfarm Job Openings have been declining since mid-2022.

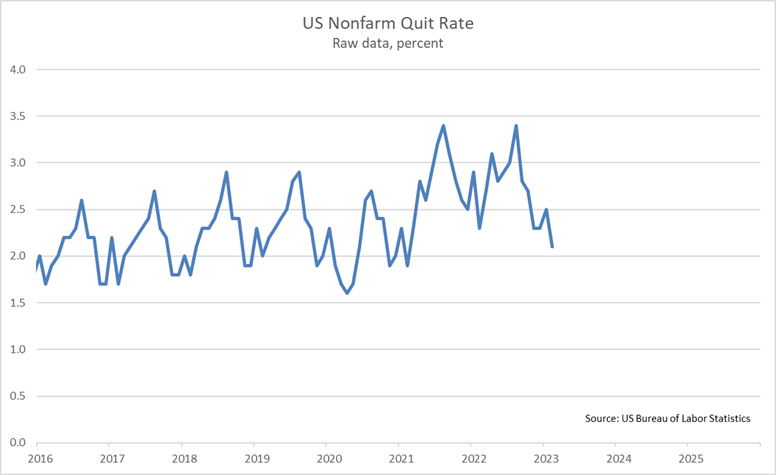

The US Nonfarm Quit Rate has developed an analogous trend; this is evident in the recent downward trajectory of the raw data, which is discernible through the seasonal undulations.

For companies dependent on workers, the two trends – both of which are poised to continue – will be welcome. With fewer Job Openings, the implication is that the tightness in the labor market is moderately easing, as there is less demand for workers. This is what the Federal Reserve wants to see, and it could lead to a cessation of interest rate hikes by the FOMC.

The Quit Rate trend is declining as uncertainty mounts. Workers are more inclined to stay where they are versus taking a chance on the job market. A more stable workforce means lower costs for hiring and training and will ultimately mean less wage inflation in 2023 and 2024.

Less Positive for Employees

Appreciable decline in Job Openings and slowing ascent in wages has the potential to mean that labor income will not exceed inflation. This would indicate a consumer in rough shape. However, we are forecasting that despite some easing in labor pressures – enough for companies to leverage – the relative tightness in the labor market will persist through at least 2025.

There is more on this people-oriented topic, including our expectations for wage inflation and the latest trends’ implications for the Federal Reserve’s course of action going forward. We covered it in depth at our March 23 Executive Series Webinar, “Economic Storm Watch.” The recording is available. To keep abreast of what is going on with the Fed, follow our YouTube channel – ITR Economics CEO and Chief Economist Brian Beaulieu releases a new “Fed Watch” video weekly.