Since the COVID-19 pandemic triggered a global recession, the US Federal Reserve has been quite active in its attempt to support markets and the economy. Beginning with an emergency meeting in early March, the Fed cut the Federal Funds Rate to a range of 0–0.25% and instituted a wide array of programs aimed at shoring up liquidity, market functionality, and confidence.

Revisiting Great Recession Programs

The Fed had honed many of these programs and strategies during the Great Recession of 2008. Most notably, the Fed did not hesitate to reinstate a near-zero effective Federal Funds Rate and forward guidance. Other crisis-era programs made a comeback, including large-scale asset purchases of treasury and mortgage-backed securities, the Primary Dealer Credit Facility, the Money Market Mutual Fund Liquidity Facility, Term Asset-Backed Securities Loan Facility, and expanded international swap lines.

Federal Reserve Response in 2020

However, the Fed’s response to the current crisis was not only much quicker than the Great Recession response but also much more aggressive in scope. For example, the Fed lowered the discount window rate to 0.25%, which is lower than during the 2008 crisis, and extended the term of discount loans directly from the Fed to 90 days.

Other 2020 strategies included relaxing requirements for regulatory capital and liquidity buffers, expanding eligible collateral to existing programs, and the unprecedented step of removing banks’ reserve requirements. New facilities extended the Fed’s scope beyond traditional financial market intervention to corporations and municipalities, including the Primary and Secondary Market Corporate Credit Facility, the Commercial Paper Funding Facility, the Municipal Liquidity Facility, and the Main Street Lending Program.

While forward guidance was used during the Great Recession to exert downside pressure on longer-term interest rates, even the tone of comments has become more aggressive, as in Fed Chairman Jerome Powell’s recent statement that the Fed is not “even thinking about thinking about raising rates.”

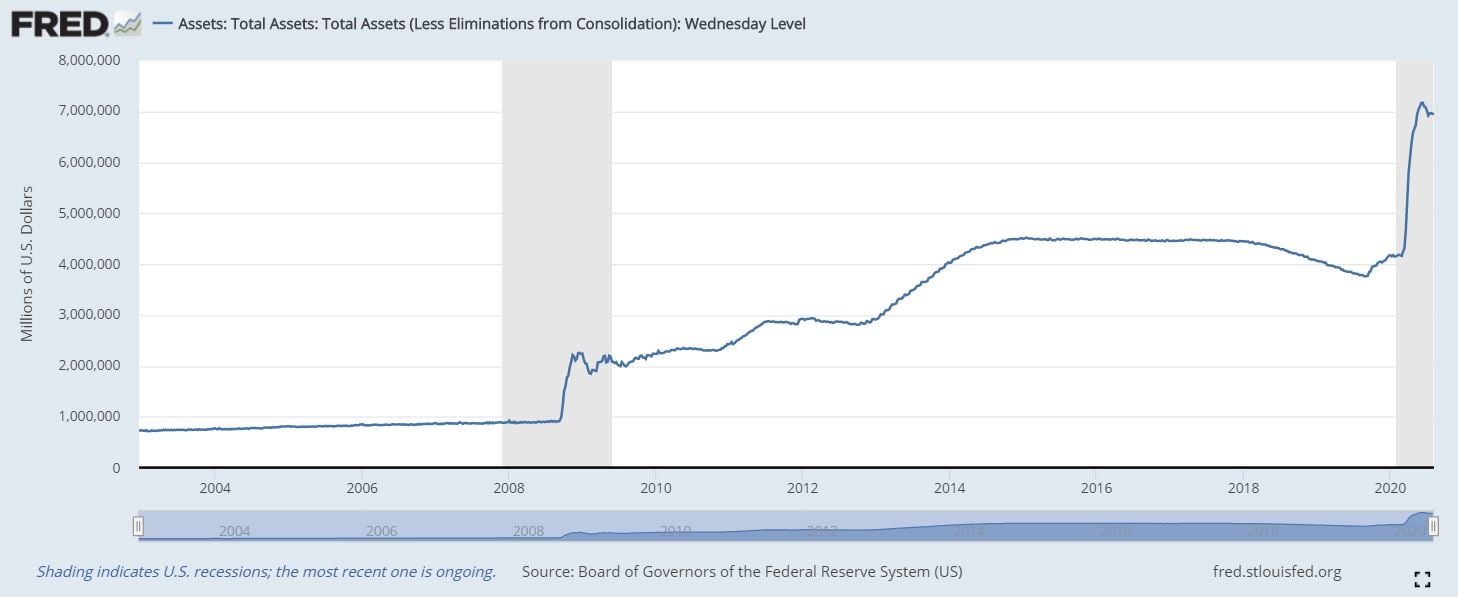

The 2020 size increase of the Fed’s balance sheet visibly dwarfs the 2008-09 increase, as seen below, bringing total assets to nearly $7 trillion at the end of July. More importantly, the rapid increase occurred around the start of the recession (represented by shading), in contrast with the delay seen in the 2008 example.

Assets: Total Assets: Total Assets (Less Eliminations from Consolidation)

Shading indicates US recessions; the current recession is ongoing. Source: Board of Governors of the Federal Reserve System (US)

Altogether, the Fed’s reaction was both quicker and more aggressive in 2020 than it was in 2008.

The Federal Reserve learned many lessons during the Great Recession, then acted swiftly and decisively when the current situation arose. What lessons did your business learn in the last recession, and how can you apply them in the current economic environment? If ITR Economics can help you refine that plan, please reach out!

Lauren Saidel-Baker

Economist