There is a human tendency to conflate individual events with overall trends. While news and market observations are a critical component of our analysis and forecasting here at ITR Economics, we prefer to focus on the big picture when it comes to informing business decisions. Near-term events and news flow will be volatile, but management decisions should not be.

In the second half of 2020, we at ITR affirmed that leading indicators were pointing toward macroeconomic recovery by the first half of 2021. At the time, we were met with skepticism, but now that rebound in demand is materializing, and many firms are not prepared to meet it. In addition to the normal increase in demand spurred by economic recovery following a deep global recession, many firms are also rebuilding depleted inventories. Together, these factors are contributing to a demand picture that is straining some capacity limits.

Aside from industry capacity itself, the demand for shipping is currently outpacing a still-diminished availability for moving raw materials, inputs, and finished goods. It is all too easy to ascribe this ongoing imbalance to one-off factors, such as a container ship run aground in the Suez Canal. Yet the supply-demand discrepancy remains, and that ship has sailed.

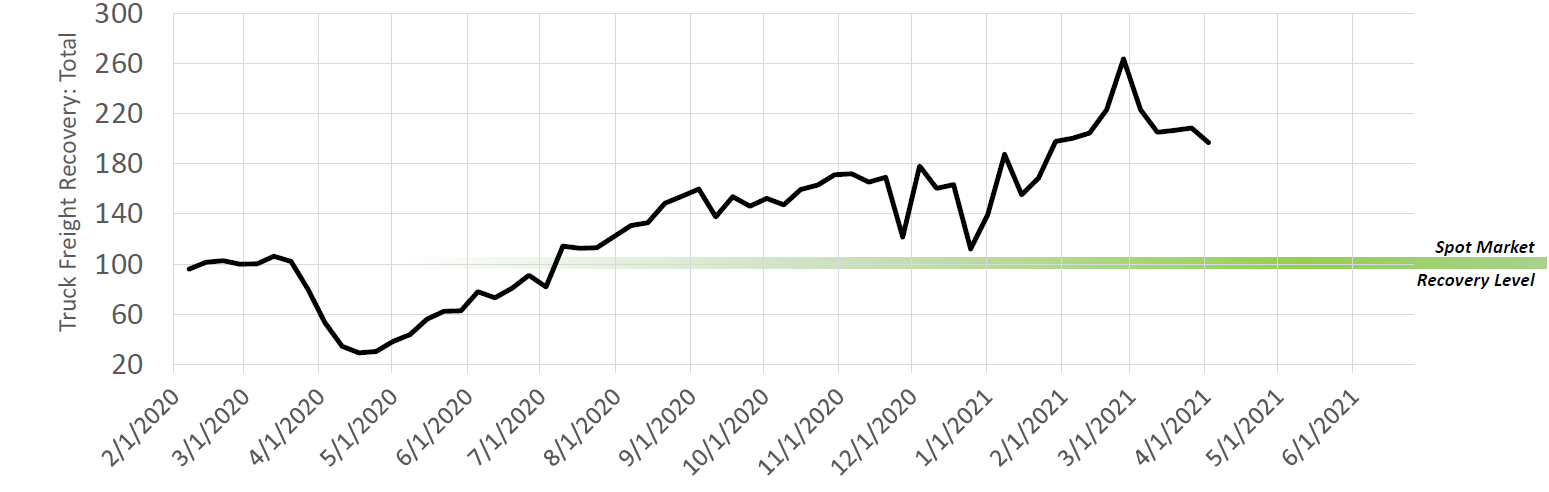

It may surprise some readers to know that the US Truck Freight Recovery Index surpassed the spot market recovery level in the summer of 2020. In fact, this indication of demand fell for only a few short months last year.

US Truck Freight Recovery Index

Note: 100 = Full recovery to pre-pandemic volumes

Sources: Truckstop.com Spot Market Insights, FTR Transportation Intelligence™

This data clearly show a sustained and prevailing trend, not a short-term impact from one event. While the Suez Canal blockage certainly exacerbated shipping woes, it was not the sole cause. Critically, the removal of this obstacle also does not imply that all shipping strains will now ease.

For many firms, this demand imbalance is a “good” problem to have. However, even positive problems will require attention. This year, it will be critical to plan ahead to ensure that inputs – from raw materials to labor – are ready in time to meet rising demand levels. Communicate both with your suppliers and your own customers to overcome obstacles, such as order allocations, that will be more likely in the coming months. Consider whether a company sales forecast may be beneficial as you target your planning levels and resource allocation.

As a business leader, it is your job to look beyond the noise of the news flow and discern the underlying trends. Volatility and alarmist headlines sell newspapers, but they should not be the basis for management decisions. Responding to such events as they arise is reactionary at best. Instead, look to the leading indicator evidence and to a proven methodology that will allow you to look ahead and to see the big picture.

Lauren Saidel-Baker

Economist