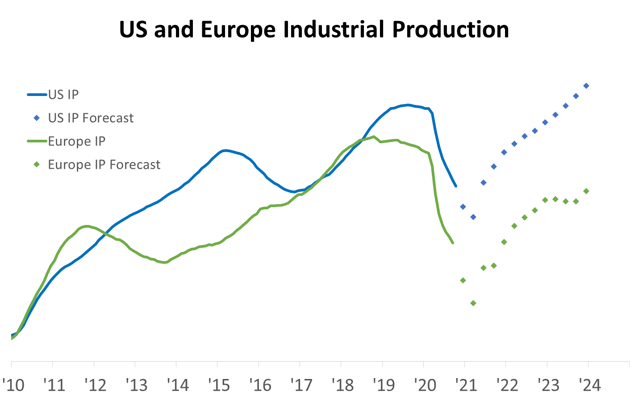

Not all recoveries are created equal, and for planning purposes, knowing the differences can be crucial. By now, you’ve heard from us that US Industrial Production is in the early stages of recovery, with the 3/12 in its fourth month of rise. Annual Production activity is projected to surpass the August 2019 pre-recession level during the second half of 2023.

This month, you saw in Connor Lokar’s blog that Europe Industrial Production is also in the early stages of recovery, with its 3/12 also in its fourth month of rise. However, this is where we encounter a crucial difference. Through our current forecast horizon, through year-end 2023, Europe Industrial Production does not achieve a full economic recovery like the US does. In contrast, by the end of 2023, Europe annual Production is projected to be approximately 4.5% below the pre-recession level.

As you’ve heard us say, the US economy was not broken prior to COVID-19, which is why we are able to achieve a strong rebound moving forward. The European economy cannot make the same claim. Even before we entered 2020, Europe Industrial Production had been contracting for 14 months. Trade wars and Brexit were taking a toll and left the European economy in a weakened state for 2020.

Looking forward, Europe’s pain points have not been resolved, and trends of increasing nationalism and poor demographics will further limit Europe's ability to recover in the future. Individual markets will vary, but if your business closely aligns with Industrial Production, expect stronger growth opportunities in the US than in Europe as a whole for at least the next three years.

Jackie Greene

Director of Economics