Several weeks ago we noted that near sourcing and onshoring efforts in the US were contributing to a boom in manufacturing-related construction, particularly as it relates to our domestic semiconductor production ambitions.

Simple imports data also suggests a US push to secure nearer, and in some cases friendlier, sources of inputs and finished goods.

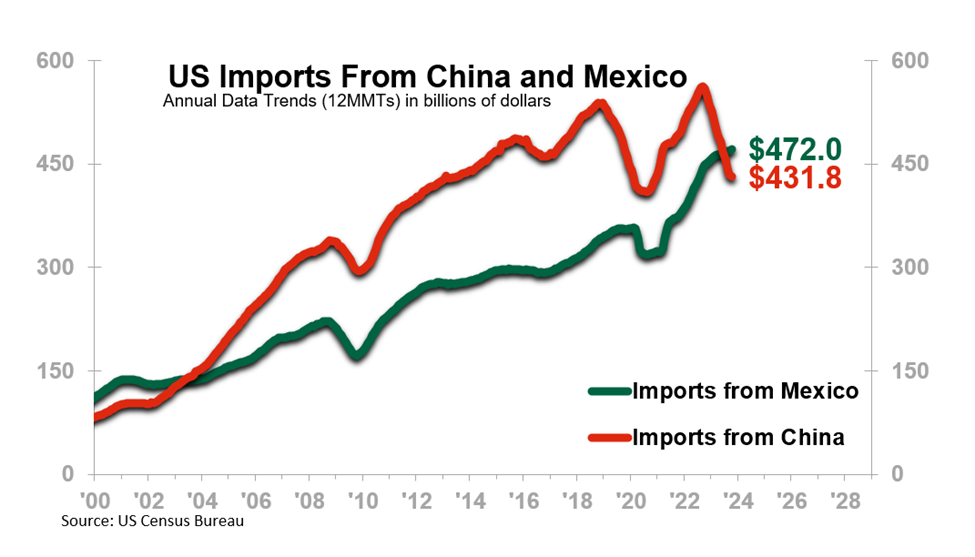

The chart shows a change in the business dynamic between the US and two of our key trade partners: Mexico and China.

- Since the early 2000s – May 2003, to be exact – the US Imports From China 12-month moving total (12MMT) has trended above the US Imports From Mexico

- That longstanding dynamic reversed in July of this year, when our imports from Mexico (measured in billions of US dollars) exceeded our imports from China for the first time in two decades.

- The deviation has widened in the three months since then.

It is important to note that the cross of the lines is only part of the story, however. Looking at the two Imports trends separately, we can see:

- Imports From Mexico have been trending upward on a relatively consistent trajectory, notwithstanding a few notable interruptions around the Great Recession and the COVID-19 shutdowns.

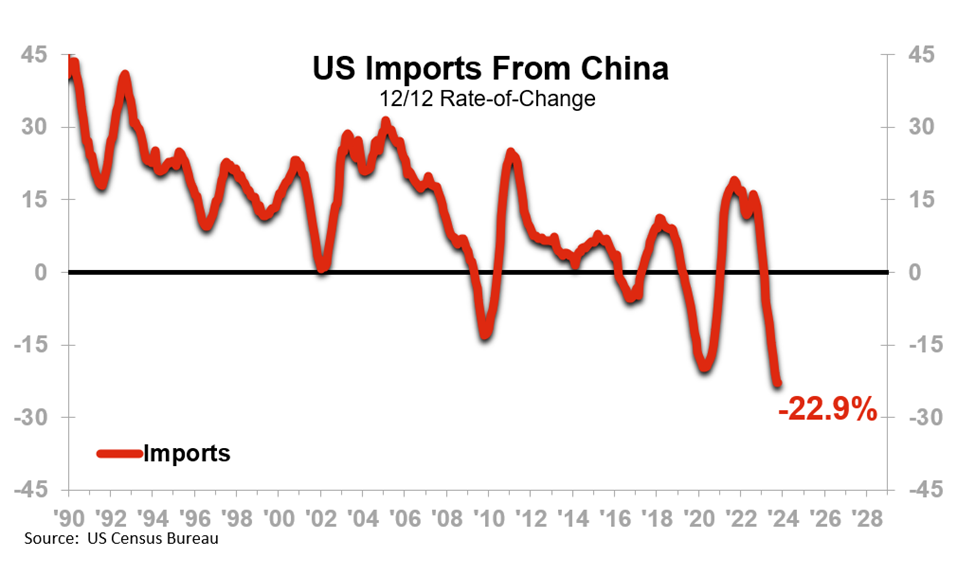

- Imports From China were trending upward on a similarly consistent trajectory, until two notable periods of decline, the first starting at the outset of 2019 and the second starting in late 2022 (and ongoing into the present).

- The current decline in Imports from China is more severe than prior declines – the 12/12 rate-of-change (i.e., the status of the 12MMT relative to where it was 12 months before) is lower than it has ever been.

- It is very likely true that there is a relationship between the Imports From China trend and the Imports From Mexico trend, as goods that are too expensive to bring in directly from China because of tariffs are to some extent being run through Mexico to avoid those tariffs.

- Some Chinese companies are reportedly relocating facilities to other countries to get around tariffs and, perhaps in some cases, the US business world’s apparent desire to be less dependent on a country that appears increasingly at odds with its own.

- If such a company manufactures or finishes a product in Mexico, for example, the data will record that product as coming from Mexico. It will not be “made in China,” but it will be, in a sense, “made by China.”

What It Means

The US is shifting its trading relationship relative to China.

- Our efforts to ramp up semiconductor manufacturing stateside is one piece of evidence for that.

- The tariffs that the Trump administration imposed on China have largely remained in effect into the Biden administration.

- Some companies are shifting their supply chains away from China on their own accord, at least where margins, lead times, availability, etc., allow.

- China’s own data suggests the country may be drifting away, over the long term, from “world’s low-cost manufacturing floor” status. ITR Economics President Alan Beaulieu wrote about it in a blog earlier this year. Foreign direct investment into the US shows that the US is the #1 destination of this capital; China was a net negative figure in this regard.

- The US Imports data is clear that we are importing less from China.

ITR Economics is an authoritative source on the US economy, but we also delve extensively into the economies of our trading partners. To keep up to date on shifting dynamics and to understand how, when, and where to take advantage of onshoring and near sourcing trends, follow us.