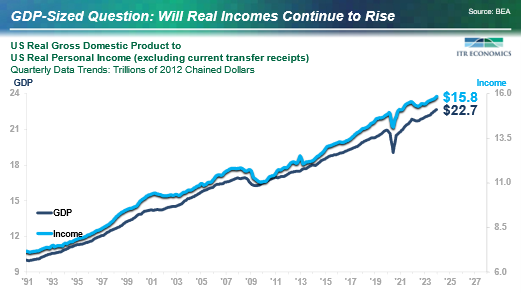

- The resiliency of the trend supports an upward bias to the GDP trend for 2024.

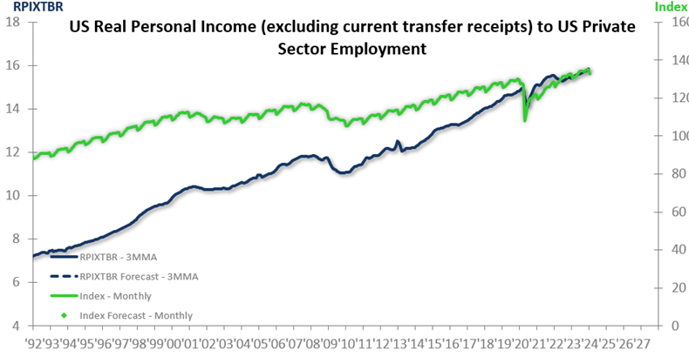

- The tight labor will play a role in keeping the income trend generally positive.

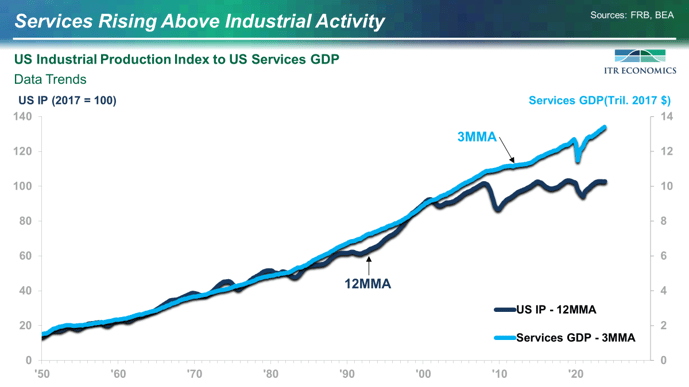

- Different dynamics are at work for Services versus Industrial activity within the overall economy.

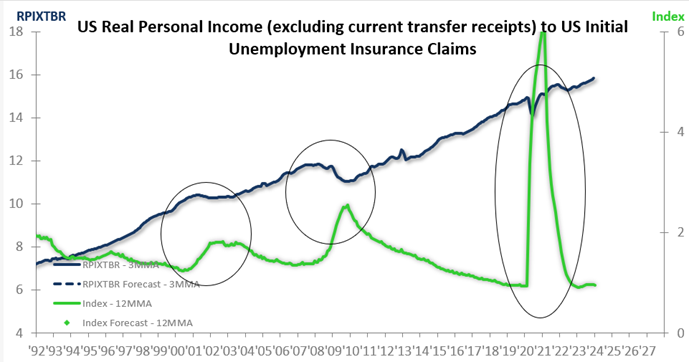

Indications of an escalation in Initial Unemployment Claims would be a red flag for positive trend probabilities for Real Personal Income. Fortunately, there are currently no such indications despite the reports of layoffs. Initial Unemployment Claims for the three months ending in January 2024 were 5.7% lower than one year earlier. A close examination of the chart below shows that the Initial Claims data trend is moving lower from a tentative November 2023 high following 10 months of rise. The rates-of-change are less than zero and are trending lower, suggesting that the nascent rise in the 12MMT will revert to a modest decline.

We are not anticipating a surge in unemployment given the tight labor force, record-high corporate profits, strong corporate cash positions, and upside leading indicator signals beginning to develop, such as Single-Family Housing Permits and Single-Family Housing Starts.

The chart below illustrates the relationship between employment growth and income growth.

See the ITR Trends Report™ for the three-year forecast of Private Sector Employment.

Even given Employment weakness in sectors of the economy where mild recession is probable, such as manufacturing and durable goods distribution, we think it unlikely that the overall Employment trend will turn downward given the rise in the larger service sector of our economy (see chart below).

This is not to say that Real Personal Income will continue to rise unabated. We think the rate of rise in earnings will dissipate as businesses provide smaller pay increases in the coming year and the demand for labor, while still positive, is not as strong as it has been.

The Point

Consumers are faring reasonably well despite the inflation endured in recent years, as evidenced by incomes that are generally rising in real dollar terms. Some of their discretionary income is being siphoned away to higher prices for insurance and automotive repairs, but that is offset by lower energy prices.

High-end income earners are likely to fare best during 2024. Orienting resources with this in mind will provide a more stable revenue base and will potentially keep your operating margin(s) healthier.

Keep the material presented above when the politicians start to tell you how “broken” the economy is or how consumers are “worse off than ever.” Neither statement is true when you go by the numbers. By the Numbers is a new subscription service we will launch later this year. It will be a video service focused on getting beyond the headlines and looking at what the numbers are telling us at ITR Economics and what they mean for you.