The following are not New Year’s resolutions, but rather imperatives that happen to coincide with the start of the new year. If you wish to not only grow your business over the next several years, but also optimally position it for the 2030s economic depression – whether you plan to sell ahead of it or persevere through it – then now is the time to act.

1. Take the Depression Seriously, Because It Is Coming

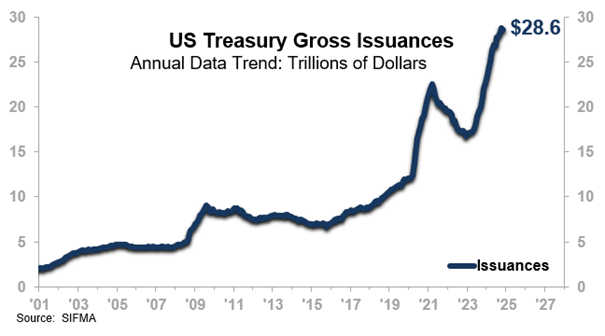

The current state of affairs is not sustainable. Popular wisdom associates extreme government debt spending with the COVID years of 2020 and 2021, but that time merely set the tone for a new “normal.” The chart below shows US Treasury Gross Issuances, which provide an approximation for the amount of debt the federal government is willing/compelled to take on in order to provide the funding for its initiatives and responsibilities. We have been trending above the peak COVID level since year-end 2023. Debt spending is unlikely to moderate in the years leading up to 2030 as more baby boomers retire, increasing the load on Social Security, Medicare, and other programs.

2. Get Ready for Inflation

The headlines about consumer pain amid inflation are still with us, but not with the same fervor or frequency of the past few years. That is because inflation has eased. However, we expect this trend will prove temporary, for several reasons:

- The government spending outlined above, and the attendant increase in sheer liquidity, is one reason.

- There is also the trend toward nearshoring and away from globalization. While this will help domestic manufacturers secure their supply chains in a world currently characterized by conflict and tension, it will also put upward pressure on prices.

- We expect overall US Producer Prices to rise through at least 2027, with inflation starting to pick up around the middle of this year.

We do not expect inflation to be as severe as the pricing trends that came in the wake of COVID and government stimulus. However, it will be high compared to the relatively low levels that many grew accustomed to during the 2010s. If you do not have a plan to deal with inflation, it will eat away at your margins.

- Identifying and leveraging the pricing data most applicable to your business (we can help) is one step to take.

- Then, you will be able to implement regularly timed price increases of sufficient magnitude to protect your margins without alienating customers.

- Consider passing through tariff-related cost increases if they arise.

- Look to save on costs or slow cost increases on your production side. Implement more automation or other labor-saving improvements that will help you mitigate the wage inflation attendant to our aging workforce.

3. If You Are Planning a Capital Investment, Do Not Delay It for Too Long

Future Federal Reserve rate cuts will be limited in number and magnitude. The marketplace is showing little appetite for lowering interest rates.

- The Fed began cutting rates in September, but US Government Long-Term Bond Yields, a measure of longer-term borrowing costs, have remained essentially flat.

- Rather than waiting for better terms, you will likely be better served to calculate the time it will take your capital investment – including order-to-delivery time, setup, and implementation – to deliver the ROI you are seeking. Be sure such improvements are up and running in time to help you capitalize on growth in your market.

- If you trend closely with overall US Industrial Production, expect growth to start picking up around mid-2025.

- If your market trends differently, we can provide you with an accurate timeline for anticipated growth (or stagnation/decline) via our consulting services.

Now is the time to prepare to make the most of 2025 and the second half of this decade so that when the depression hits, you will have left everything on the field.