As a business leader, think about your inventories for a moment. Which is better: when your inventories are growing faster than your sales, or when your sales are growing faster than your inventories?

It is not a trick question — of course the latter is better.

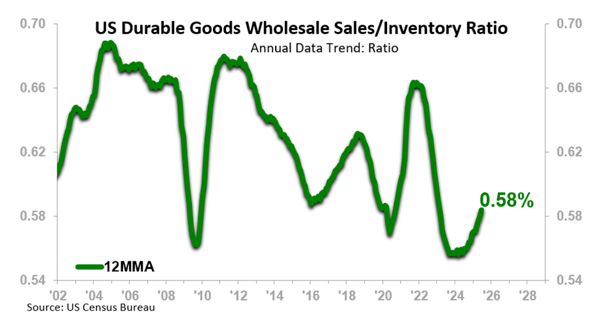

The same is true for the overall economy as well — rise in the US Durable Goods Wholesale Sales-to-Inventory Ratio is generally considered a good thing. In the chart below, the recent rise in the ratio looks like a ski jump:

Here Is Why a Rising Sales-to-Inventory Ratio Is a Good Thing:

- Indicates Strong Demand: Higher sales relative to inventory suggest that customers are buying at a faster pace, reducing excess stock.

- Efficient Operations: A rising ratio suggests that wholesalers are less likely to be overstocked, indicating lower storage costs, a reduced risk of obsolescence, and improved cash flow.

- Confidence Signal: Rising ratios often reflect healthy consumer activity and effective inventory management, both positive signs for business performance.

More specifically, here is why rise in the Durable Goods Sales-to-Inventory Ratio bodes well for the overall US macroeconomy:

- Signals Broad Economic Momentum: Durable goods — defined as goods lasting three or more years — are closely tied to business investment and consumer confidence. Rising ratios show that end demand is strong enough to pull product through the supply chain.

- Catalyst for Industrial Activity: As inventories run lean, manufacturers must boost production and restocking, creating ripple effects across transportation, energy, and raw materials industries.

There are some caveats to the positive signals outlined above.

Clear Signal, but Relatively Short Lead Time

- Historically, the ratio leads US Wholesale Trade of Durable Goods and the broader macroeconomy by about two quarters.

- That means the rise in the ratio through June (the most recent data available) gives us a positive signal through the rest of this year, but not into 2026, yet.

- For longer-term forecasting, ITR Economics uses a system of leading indicators, internal trend analysis, and our proprietary long-term business cycle theory to achieve high accuracy.

The Durable Goods Sales-to-Inventory Ratio Is Still Comparatively Low

- This is visible in the 12MMA chart.

- The sharp “ski jump” in the 12MMA is encouraging, because such a steep climb is exactly what is needed to bring the ratio closer to its historical norm.

For some context behind the relatively low level of the ratio — from mid-2020 through much of 2021, the ratio spiked sharply, driven by both a surge in sales (pent-up demand) and depleting inventories (COVID-era supply chain disruptions). But from that peak, the ratio declined sharply through 2024, reflecting normalizing supply chains and cooling demand.

What the Rising Ratio Means for Businesses

- Stronger Short-Term Demand: Expect durable goods demand to hold firm through the coming quarters.

- Investment Timing: The positive signal for the rest of 2025 gives businesses confidence to move forward with planned investments.

For Your Business Specifically?

- The answer will depend on whether you deal in durable goods and, if so, the category of durable goods you deal in.

- We have wholesale trade data — including sales-to-inventory ratios — for a wide range of markets.

- Knowing how your business compares to these metrics helps you see what is coming next but also helps you identify if you are losing market share.

Going into greater depth for your specific markets will enable you to make investment decisions with confidence and help you avoid costly missteps as you navigate the tariff-impacted supply chain era. Contact us to learn how to use these indicators to their maximum potential to drive your business to the next level!