“Seeing the Future First” is important at ITR Economics, as it sums up our purpose and our passion. That is not always easy for a business leader, even a seasoned one, to do. As an example, I was talking to a few business leaders I respect who are suppliers in the world of nonresidential construction. They are very optimistic about the future, and our forecast was not easy for them to align themselves with.

Nonresidential Construction Today

The optimism is understandable. The Nonresidential Construction 12/12 and 3/12 are at 11.1% and 19.7%, respectively, and both are in Phase B, Accelerating Growth. The fact that the 3/12 is above the 12/12 is important as a signal of more rise in Nonresidential Construction spending through the near term. The 12MMT is a record high $540.9 billion, and the January seasonal decline in the 3MMT is the mildest on record. The optimism is very understandable.

Special Events

There are also two special events that are fueling optimism in Nonresidential Construction for the next several years. One is the Infrastructure Investment and Jobs Act, and the other is the construction of semiconductor chip fabrication plants in the US. There is no doubt that many communities, companies, and individuals will benefit from the planned and impressive levels of spending. However, it should be remembered that the spending will occur over the next three to five years and that not all suppliers will benefit from it. For example, Company A bids and receives the purchase order to supply all the doors for a new fab plant in Ohio. That is great for the manufacturer and distributor, two companies that will definitely benefit. But all the other bidders receive no benefit. It is great news for a few, but less so for the industry as a whole.

The Future

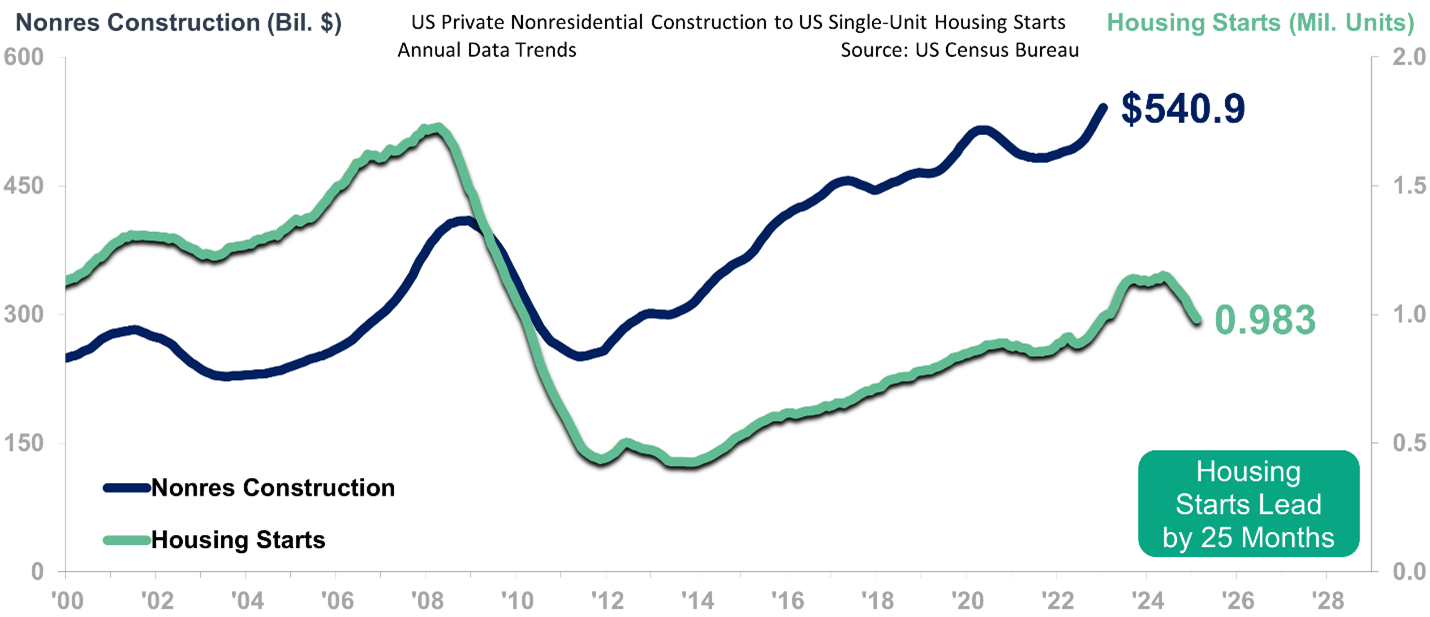

The optimism of today, and the anticipation of future spending, do not override the past. The chart below shows the relationship of Housing Starts to Nonresidential Construction (both 12MMTs).

Note that the recession in Housing Starts heralds a recession in Nonresidential Construction. The 12MMT for the former leads the 12MMT for the latter by 25 months. The Housing Starts 12MMT peak in April 2022 places the typical timing estimate for a Nonresidential Construction 12MMT high in May 2024; we are forecasting a second-quarter-2024 12MMT peak. The good news of the moment and the promise of more nonresidential construction spending make it easy to look past the historical relationship, but that relationship has not failed in over 20 years, and that everyone will benefit from targeted spending is not a logical assumption.

Plan and Prosper

We are projecting that Nonresidential Construction will experience a milder-than-normal decline from mid-2024 to mid-2025. The mild decline is consistent with our macroeconomic outlook and with the selected benefits from the CHIPS and Science Act and the infrastructure package. Most suppliers and contractors would do well to expect less activity from mid-2024 to mid-2025 and plan their bidding and backlog needs accordingly.