Three decisions you need to make

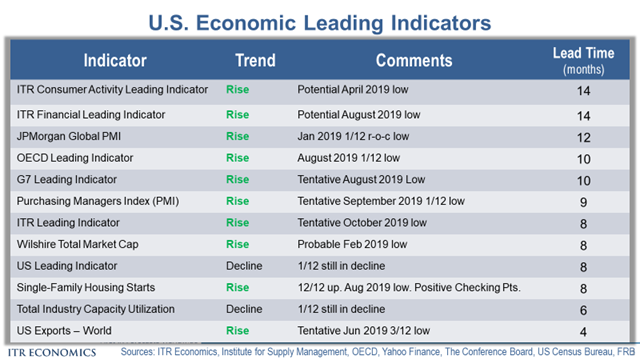

The US economy will be heading higher in 2020, most likely beginning around mid-year. Our leading indicator system is providing too many “green lights” for this not to be the most probable trend. See the table below. Only the Conference Board's US Leading Indicator and US Total Industry Capacity Utilization are failing to provide a “go” signal for the second half of 2020. You should plan on being busier in 2H20 and busier than that in 2021 if you tend to move with either GDP or US Total Industrial Production. (Let us know if you aren’t sure – we can help you find out.)

Decision #1

Do your budgets and plans for 2020 reflect the impending change in direction for the US (and global) economy?

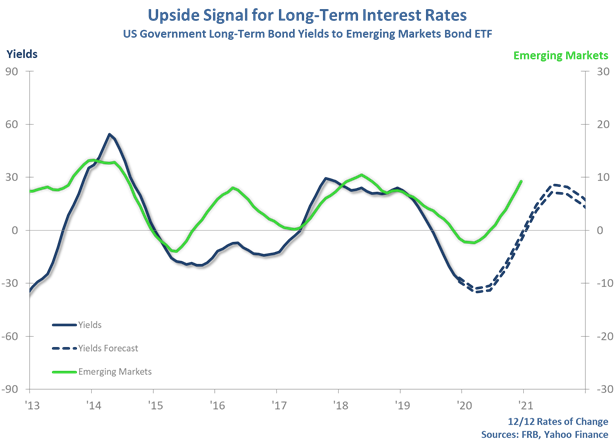

A strengthening economy will likely lead to higher interest rates, also beginning in the second half of 2020 and continuing through 2021. The forecasted trend is logical based on the improving global macroeconomics (demand), trade inefficiencies and labor cost trends creating inflationary pressure, and the voracious appetite in some of the global economy for liquidity via more debt.

We have a leading indicator for long-term interest rates. See the chart below. The 12/12 rate-of-change for the Emerging Markets Bond ETF is signaling that a trend reversal toward higher long-term interest rates is in the offing.

Decision #2

Have you thought about how leverage could help you a) maximize the coming rising trend, b) build on a strategy to mitigate the 2022–2023 recession, and c) buy property to create additional wealth over the longer term?

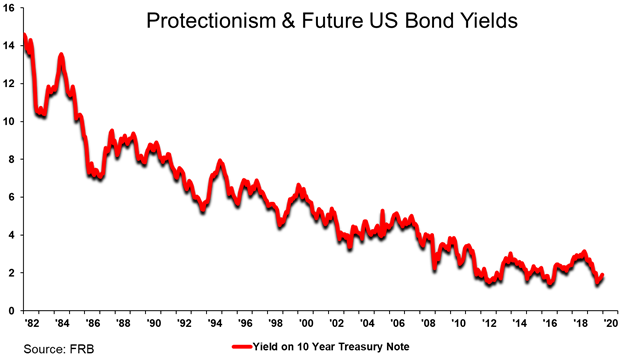

ITR Economics’ speakers are on the road in increasing numbers, and we are advising people that globalization is giving way to de-globalization/nationalism. The latter will breed economic inefficiencies and alter capital flows. Both ramifications will tend to spur interest rates higher (albeit for different reasons). It was the age of globalization that gave us the amazing, elongated decline in interest rates from the early 1980s to approximately 2012–2016 (see the chart below). Globalization created a global deflationary environment (reflected in interest rates because interest rates are simply the price for renting someone else’s money). It is the reverse of globalization that we have ahead of us. Therefore, we don’t expect just a business cycle rise in interest rates in 2020–2021; we expect a long-term rising trend in rates to characterize the 2020s. What we see via the chart is only the beginning of a long (non-linear) rising trend.

Decision #3

Would you rather borrow money now, before interest rates go higher, or borrow in the future once rates have started their climb to the next pinnacle?

We sincerely hope

- you know how you relate to the economy and are poised for taking well-timed action with budgets and plans set accordingly

- you know what technology/capital equipment/major asset(s) would propel you past your competition and set you up to dominate and establish effective profit margins

- you borrow now, leveraging the future now, knowing you have a plan for dealing with the 2022–2023 recession and are determined to grow through that cycle and those to follow.

Brian Beaulieu

CEO