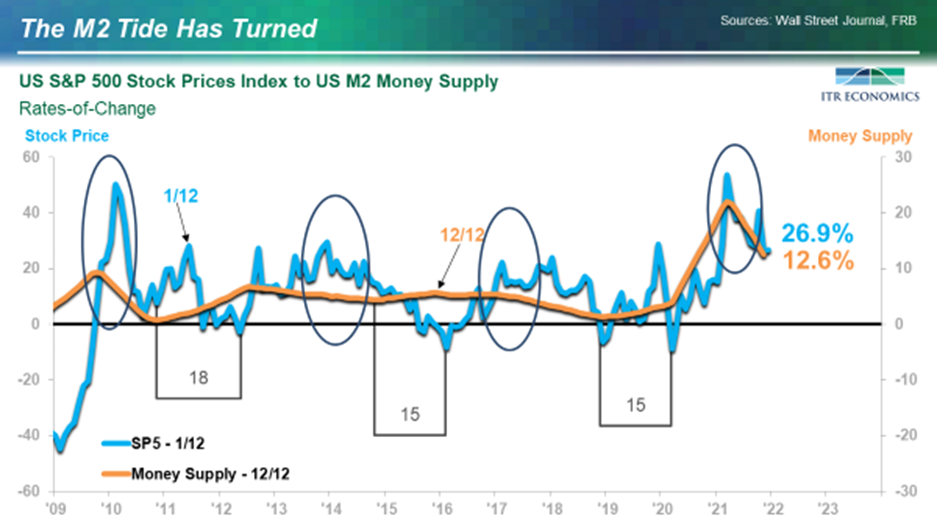

We first showed the chart below at the December 2020 ITR Webinar hosted by Alan Beaulieu and me. At the time, the M2 Money Supply 12/12 rate-of-change was still rising, and we correctly stated that the full impact of the soaring growth rate in M2 had yet to be felt.

Fast forward to today, and we have a different picture. The Federal Reserve is easing the stimulus impetus, as evidenced by the declining trend in the M2 12/12 rate-of-change. The implications are that it is time to switch from playing a strong offense to playing some defense. We do this via the ITR Equity Optimizer by rotating out of the cyclicals that tend to excel on the way up and moving into defensive sectors that tend to perform well relative to the overall market during weaker periods.

It is important to note some facts:

- The S&P 500 did not immediately flip from rise to decline in each of the identified instances of M2 reversal.

- It is not possible to time the market, nor do we seek to or need to.

- Defensive sectors provide added lift in these scenarios even when the overall market is still rising.

- Some S&P 500 decline occurred in each instance that the M2 signaled to go defensive.

- The most severe S&P 500 declines occur in conjunction with a recession.

- We currently have a defensive signal and are in a defensive position with the Optimizer.

- No recession is projected for 2022 or 2023.

We went into the current defensive position too early, and it cost us in terms of Optimizer performance. By stripping the model down and reevaluating the signals themselves and the timing involved, we discerned the signals were fine, but the timing of implementation was off in this cycle in a way that we had never seen before. We then went back and examined whether our past performance would have been even better had we employed the new timing metric. The answer was yes.

In each of the prior periods indicated by circles on the chart, a defensive position was called for, and the rotation would have been more efficacious had the new defensive timing paradigm been in place. Past performance is no guarantee of future results, but we have found that learning, testing, and tuning the process will lead to better results. We aren’t stopping here.

We are recording a more complete update on the Optimizer process on January 21. You are welcome to request the recording either by reaching out to me, brian@itreconomics.com, or via itroptimizer.com.

January 28, 2022 Update - Click here to view the ITR Equity Optimizer Recording.

Brian Beaulieu

CEO