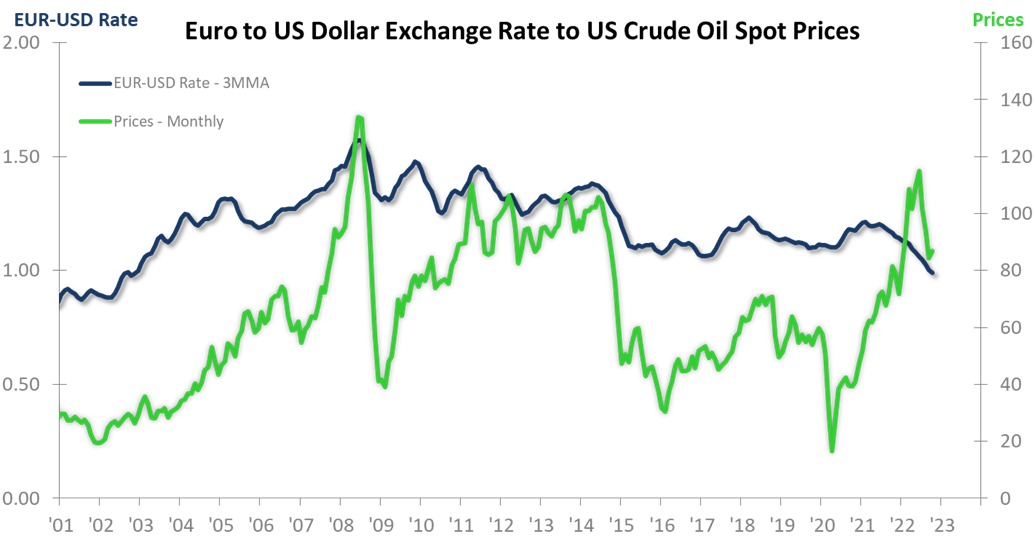

The US dollar, measured against the euro, is at its strongest point since November 2002 on a 3MMA (three-month moving average) basis. This is a change of 14.7% from one year ago and 18.3% since the USD low in February 2021. The strength of the USD has been good news for some; it represents a difficulty for others. From a US macroeconomic perspective, the trend is helpful for tamping down inflation in general and oil prices specifically (all else being equal).

Descent in the blue line (exchange rate) represents a strengthening of the USD. The chart shows that a strong dollar is generally associated with lower oil prices. The current situation is a notable exception caused by the war in Ukraine and regulatory/political concerns. OPEC+ recently decided to cut back on production. The strength of the USD will help mitigate the impact on Oil Prices (we use WTI).

The timing of the shift from a strengthening USD to a weakening dollar will have macroeconomic ramifications.

For example, when the blue line goes up, it reflects a weakening USD, a situation frequently associated with higher fuel prices. One of the takeaways is that when the USD shifts from strength to weakness, we are likely going to feel the impact of the OPEC+ decision. The impact becomes even more notable if the weakening dollar coincides with a shift toward improvement in the global economy.

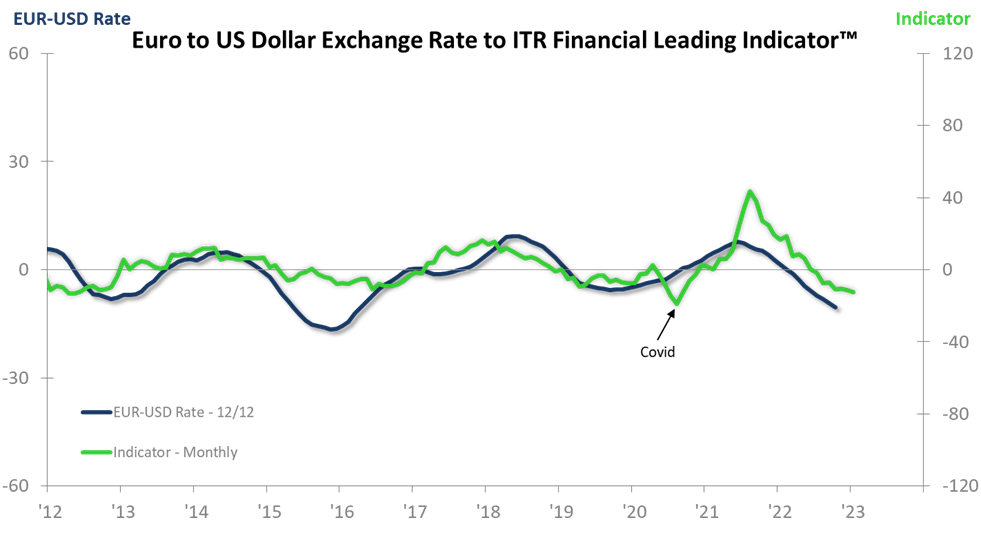

Further strengthening in the USD is consistent with:

- The Federal Reserve’s ongoing tightening

- Decline in the ITR Financial Leading Indicator™

- Decline in the World Industrial Production 3/12 rate-of-change

- Continued weakness in US Business Confidence

- ITR Economics’ outlook for the US economy

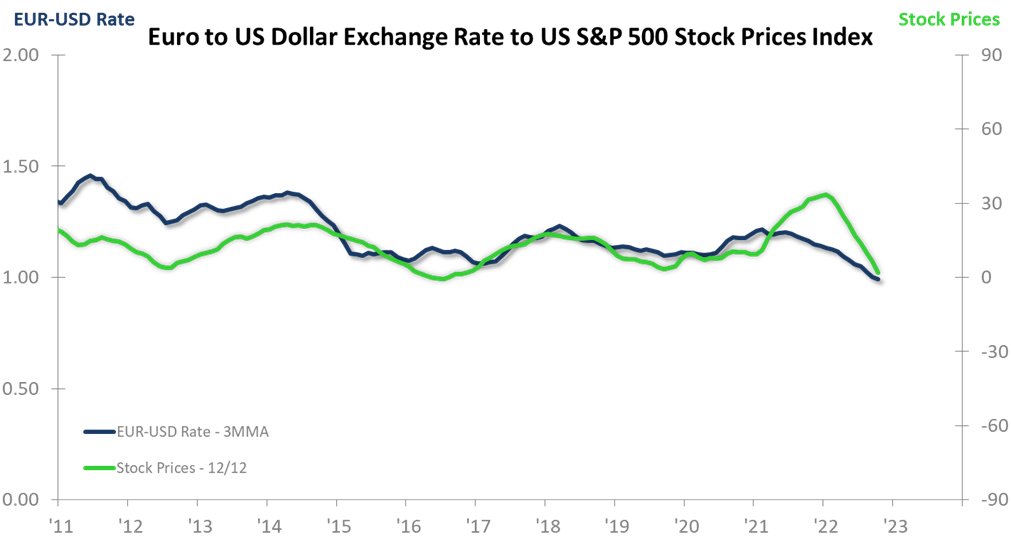

There is no useable correlation between the exchange rate and US interest rates. That the money supply correlation is useful suggests that the value of the USD is more about the supply of money as well as intangibles such as fear/uncertainty in general. However, regarding uncertainty, while an axiom in finance, we are unable to find a working relationship with either a geopolitical risk index or the US Economic Policy Uncertainty Index.

How long will the USD strengthen relative to the euro?

The current trend is shaping up to be a longer-than-normal event. We suspect this is a function of a culmination of the initially sharp US recovery from the pandemic, followed by the Fed’s drive for tightening monetary policy, and, nearly coincidently, the Ukraine war.

Unraveling this confluence is daunting. We think it is reasonable to assume that the strength of the USD will endure though mid-2023. There is the potential for an 8% strengthening of the USD between now and then. Aiding in this assessment is our confidence that inflation will abate in 2023 and the Fed will be able to ease up on its tightening policies. The sharpness of the US recovery was blunted by the decline in inflation-adjusted GDP in the first half of 2022, and we currently have probable leading indicator rise in Asia, Australia, and Brazil. The US is likely not far behind. An improving global economy will take some pressure off the USD. We think there is a reasonable probability that the dollar will ease downward in 4Q23.

A couple of interesting side observations

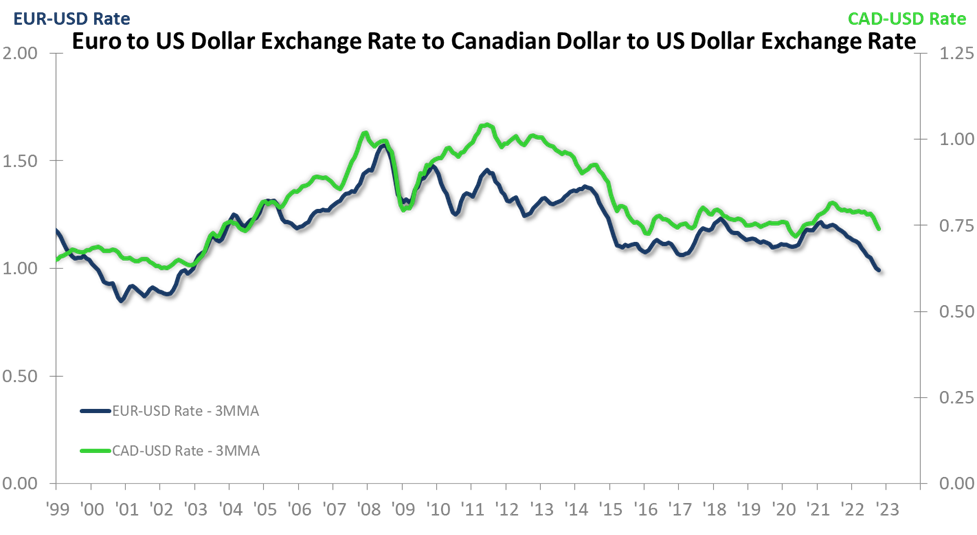

The strength of the USD is not relative only to the euro. See the chart below. The similarity of trend across different currencies is not unusual. You can plan across exchanges accordingly with a little due diligence. We can help with that.

The eventual weakening of the USD will signal a favorable market for gold price appreciation. It is historically tough for gold to sustain a price rise when the USD is strong. Investors interested in acquiring gold should have an interesting opportunity to do so in 2023.