The stock market took a noticeable tumble on Friday, August 2, and Monday, August 5. The movement is making headlines everywhere, causing some to push for the Federal Reserve to make an emergency rate cut. At ITR Economics, our job is to focus on the data and not get caught up in the excitement from other sources.

If you only have a minute, this is your takeaway: the sky is NOT falling.

Now, let’s get into the why so you can sleep a little more soundly tonight.

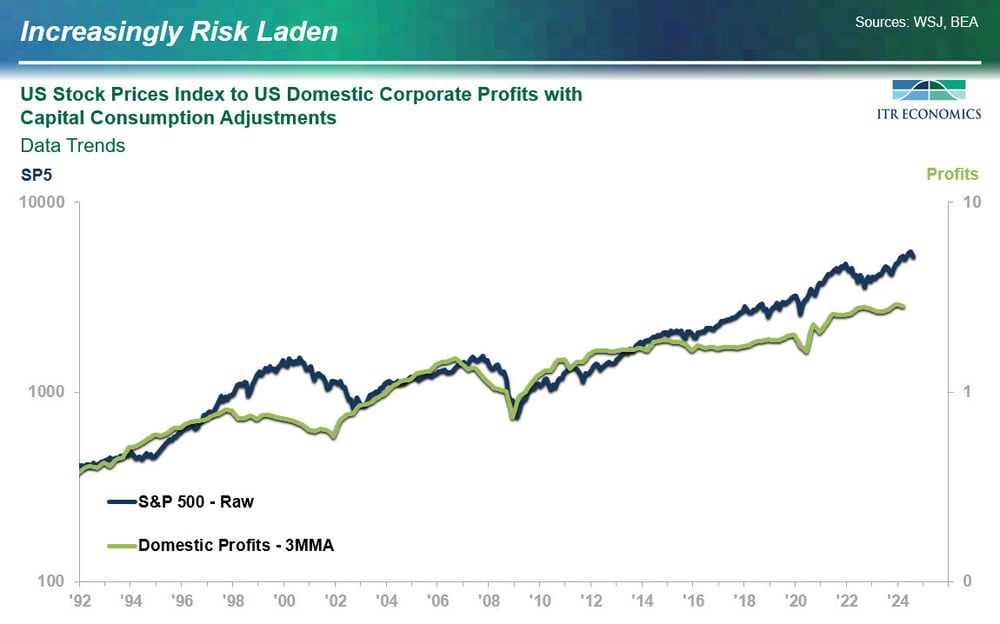

- The drop in the market is not completely unexpected or unreasonable. Our presentations have been warning clients for quite some time that there was going to be volatility in the market because corporate profit trends were not supporting the level of rise we have been seeing in the stock market. The exact when and magnitude of decline are items we do not predict, but the “economic tea leaves” were warning of trouble long before August.

The above chart shows that the difference between the valuation of the S&P 500 (blue line) and the Domestic Profits trend (green line) has been increasing. The very existence of a sizeable difference has been causing us concern since 2016 and suggested that the rise in the S&P 500 would eventually be susceptible to downside pressures. The increasing difference between these two trends has added to our concern about the likelihood of a weaker stock market in the second half of 2024. It is worth looking back on history too, as this is not unprecedented. In 1998 the gap between the S&P 500 and corporate profits widened and led to an eventual contraction in the market in the early 2000s. This suggests that a future alignment between the stock market and domestic profits is possible in the future. However, the remaining evidence suggests that level of alignment is not likely today.

- US Employment has been an area cited to explain stock market weakness. Some media outlets were reporting that hiring slowed more than expected during the past month. However, that leads me to question how realistic their expectations were. US Private Sector Employment in July was at a record-high 136.3 million people, while annual Employment trends have been at record-high levels since August 2022. If you analyze the employment data using our Rate-of-Change Methodology™, you will notice that growth is slowing. However, that is not new or surprising. Employment reached an early 2022 growth rate peak boosted by stimulus and has, since then, been working its way back toward a normal growth rate. Additionally, we have been forecasting growth to slow even further this year in conjunction with our expectations for an overall slowing macroeconomy in 2024.

- As of noon on August 5th, the latest data for the stock market and the Chicago Board Options Exchange CBOE Volatility Index (VIX) already show normalizing trends. The Dow, the S&P 500, and the Nasdaq have all generally risen as Monday morning progressed. The VIX is coming down from its early morning peak.

Stay calm and patient. Volatility is normal during this part of the business cycle. It is important to lead your teams with a calm and cool demeanor. Utilize the facts and data to bring context to the headlines. And, above all else, remember that you can always reach out to us at ITR Economics with your questions and concerns. We can be your lighthouse beacon when the outlook is foggy.