Would you believe me if I told you that the US consumer is in a better financial position today than when we entered the pandemic?

While an underwhelming jobs report and consumer inflation reaching 4.2% are monopolizing economic headlines, the consumer is nevertheless well-positioned to negotiate any turbulence in the ongoing economic recovery.

What Are the Trends Showing Us?

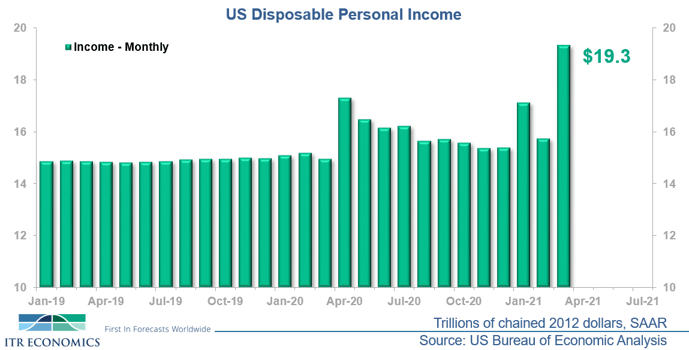

There are two metrics I will use to assess consumer strength. The first is US Disposable Personal Income (measured in trillions of chained 2012 dollars). There are a couple key points to understand regarding the data in the chart below.

- US Disposable Personal Income is trending above pre-pandemic levels.

- Each time we see a stimulus bill passed through Congress, there is a major increase in the monthly US Disposable Personal Income figure.

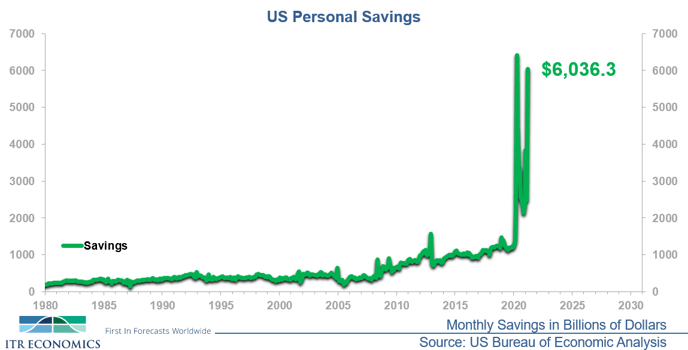

The key points noted above also apply to the US Personal Savings Rate. The Savings Rate rise illustrates that US consumers have more in their accounts than at the outset of the pandemic, and there are similar “spikes” in the Savings Rate when stimulus bills are passed through Congress.

Why Are These Trends Important?

Disposable Personal Income and the Savings Rate are important gauges of consumer health as the US economy moves through the recovery. Approximately two-thirds of US GDP is related to US personal consumption. Therefore, the US consumer's strong position will benefit GDP, propelling the US back to record-high GDP numbers before most other nations get there.

The strength of the consumer is evident outside of GDP, too - the US Single-Family Housing market is at a 13-year high! Coupled with low interest rates, the elevated savings and increase in disposable income have brought on increased demand for single-family homes. Additionally, the pandemic-induced restrictions and attendant increase in at-home time has spurred many individuals to undertake home remodeling projects.

US Total Retail Sales are also benefiting from strong consumers. The March 2021 Retail Sales figure came in at $0.624 trillion, the highest on record for single month. The February-to-March rise, at 27.3%, was also record-breaking. While the rate of increase isn’t likely to stay this robust, expect overall rise in Retail Sales this year.

The consumer is a key component of the economy's capacity to bounce back following the COVID-19-induced recession. Thanks to the above-described trends, you can expect the B2C sector to remain strong throughout 2021.

Taylor St. Germain

Analyst and Speaker