As we produce our reports and articles, we carefully consider the level of detail to provide. We ask ourselves: Do we need to expend some precious page space to explain a foundational concept, or is it safe to assume a certain level of baseline knowledge on the part of the reader?

Baseline knowledge or not, sometimes an explanation can prove beneficial, especially when misleading headlines are floating around.

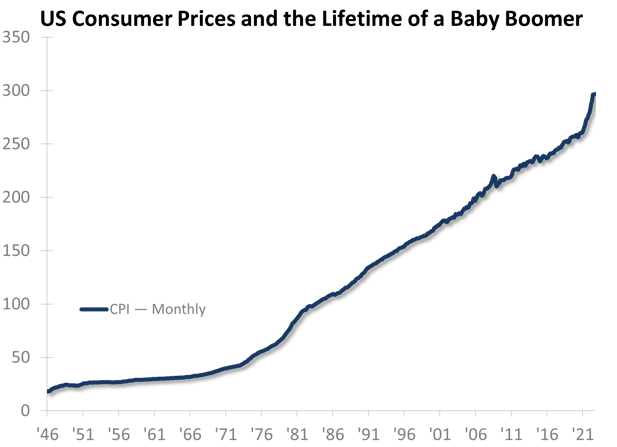

“Inflation increased 0.4% in September, more than expected despite rate hikes,” declared CNBC on Oct. 13, upon the Bureau of Labor Statistics’ monthly release of US Consumer Price Index (CPI) data. Versions of that statement circulated among other outlets as well, bemoaning a 0.4% increase in inflation.

Which didn’t happen.

Disinflation Trend Underway

CPI inflation did not increase in September. It declined, coming in at 8.2% – down from August’s 8.3%.

Foundational concept explanation incoming: Inflation is most commonly measured as the pace at which prices are rising relative the year-ago level. When inflation declines (provided it stays above zero), prices still rise; they just rise at a slowing rate. A month-to-month portrayal of inflation is at best misleading.

Where did the headline’s assertion that “Inflation increased 0.4%” come from? That figure is the month-to-month seasonally adjusted increase in the CPI itself, not in CPI inflation. In other words, Consumer Prices increased from August to September based on the seasonally adjusted index. But inflation declined.

Now, putting aside the “more than expected” part of the headline for a moment – is month-to-month rise in the CPI remarkable? The chart clearly indicates that it is not (though the recent steepness is noteworthy). Rising is what prices do.

Another point: the 0.4% increase cited by CNBC (and highlighted by the Bureau of Labor Statistics in the press materials that accompanied its data release last week) is a seasonally adjusted figure. The actual CPI increase from August to September came in at 0.2%. A peek at the historical CPI data shows that 0.2% is below-median growth for that time period.

Data-Driven Analysis

We are not here to beat up on the media, but rather to provide our clients and readers with accurate and useful insights. The latest CPI data is in line with our forecast; if anything, prices and inflation are both coming in closer to the lower end of our forecast range. Inflation may, as the headline states, be exceeding some expectations, but it is not exceeding ours.

We are not infallible prognosticators with a crystal ball. But our outlook is rooted in hard data and our trend analysis, and – although the last few years provide ample examples of world events upending such economic fundamentals – it is on track.

Business-Focused Perspective

We expect the general disinflation trends (i.e., slowing rates of rise in prices) that are solidifying now will persist into the second half of next year.

It is important to consult the right price index when planning for your business. While the media at large tend to focus on Consumer Prices, we steer our industrial and manufacturing clients toward the US Producer Price Index, or, depending on their particular markets, a more granular pricing metric – the US Construction Materials and Components Price Index, for example, or the US Electrical Machinery and Equipment Producer Price Index. We can even create a Custom Price Index that is tailored to an individual firm’s particular market mix.

Generally speaking, disinflation in Producer Prices and even deflation (outright decline) in certain commodities prices will offer opportunity to repair strained margins over the next year, for those firms with the right strategy to satisfy an increasingly price-conscious customer while navigating a tight labor market. The pieces are always moving; we’re here to tell you where to and when.