- Why build a Financial Bunker:

- You want to have as much liquidity as possible come the projected 2036 major cyclical low.

- What might be a unique factor in the 2030s:

- Demographics will create a crushing force on equity markets in the 2030s.

- How to be ready:

- Best way to plan for the low is to have a “financial bunker” at the cyclical high.

There are multiple critical elements to financially capitalizing from the economic downturn we are projecting for the 2030s. The overarching goal of our discussions/presentations of the 2030s is for you to maximize your wealth creation between now and the projected 2036 major cyclical low. This blog will have a narrower scope. We will focus on two critical periods: the top of the macroeconomic cycle (projected to be approximately 2029) and the bottom of the cycle (projected to be 2036).

It is a shame to waste the opportunities that inevitably occur at the end of a recession/depression. The best way to take advantage of those opportunities is by having an elevated level of liquidity (cash) at the bottom of the cycle to deploy on assets that will sell at significantly discounted prices.

Demographics Will Create a Crushing Force on Equity Markets in the 2030s

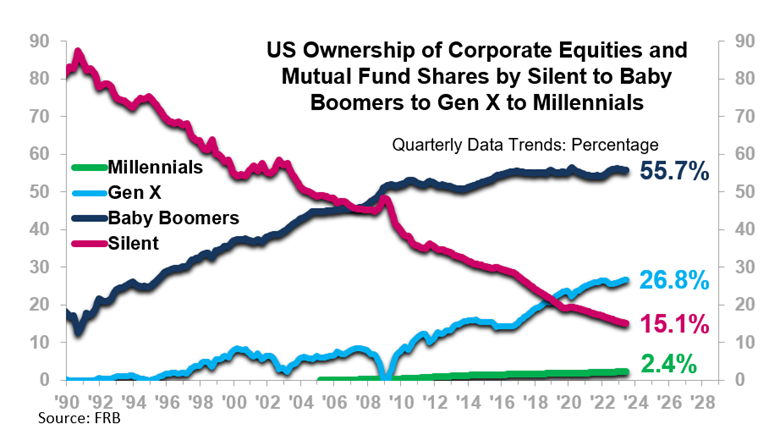

The Boomers will be less likely to hold corporate equities and mutual funds as they age as they seek to diminish portfolio risk and generate dependable income. The magnitude to which this is likely is significant. The next two charts aid in gauging the magnitude. The first chart shows that Boomers in December 2023 held 55.7% of all equities. The generation before them, the Silent Generation, held only 15.1%. The Gen X cohort held 26.8% of the total market basket of equities. Millennials are barely on the board at 2.4%.

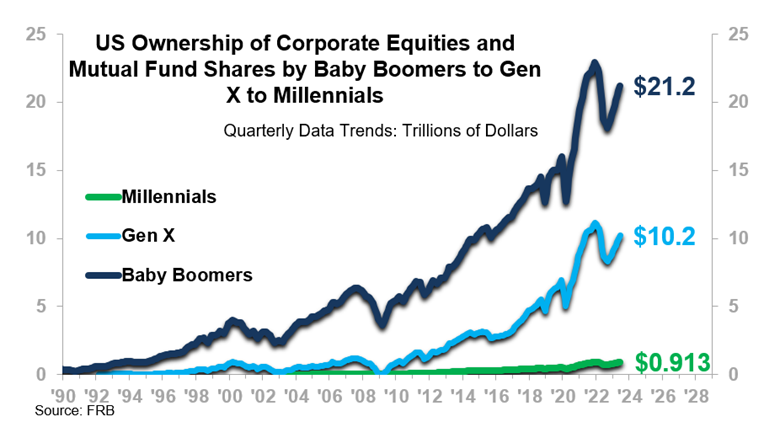

The next chart shows that as of December 2023 Boomers held $21.2 trillion in equities and mutual funds. The dollar amount is approximately equal to 94% of nominal GDP in the US and larger than any other country’s GDP. Selling that much value through the 2030s will very likely depress pricing as supply exceeds demand during the difficult, risk-laden times ahead. This is a major risk factor and why we anticipate a prolonged, non-linear bear market during the 2030s.

The bear trend will end. They always do. You will want to buy near/at the low in the market. The above also clearly suggests to us, when combined with the interest rate trend probabilities, that investors will want to be in bonds and avoid the broad stock market. Individual stocks will rise during the 2030s, but investing in the broad-market trend will not end well.

[ Fill out our form to receive the full 5-step guide for building your Financial Bunker! ]

Best Way To Plan for the Low Is To Have a 'Financial Bunker' at the Cyclical High

Exactly what the Financial Bunker will look like for any one person will vary based on the individual’s unique circumstances. Common themes to consider are:

- If you own your business, do you intend to keep it through the 2030s?

- Are you sufficiently debt free to weather something worse than 2007–09 stretched over six years?

- What assets are you holding that do well with inflation and general economic rise? Prepare to sell them at the top of the business cycle because they will not do well as we get deeper into the 2030s.

- Have you done your due diligence regarding foreign sovereign bonds?

- Determine how you will accumulate sufficient liquidity in the 2020s to take advantage of opportunities that arise.

- Consult with a tax adviser assuming tax rates on upper incomes will rise.

- Do you own property in at-risk cities and/or states?

How ITR Economics Can Help

Regarding #1 above, we have a new service offering that can help you by providing a 10-year company forecast to better inform you of the upside potential and the downside risk over the next 10 years. The service offered is Financial Resilience: Your Blueprint to the 2030s. Contact us for more information.

Getting hold of the recording of our December 2023 online seminar, “Making the 2030s Outlook More Personal,” will provide you with a deeper, richer context of the Financial Bunker and other opportunities and risks.