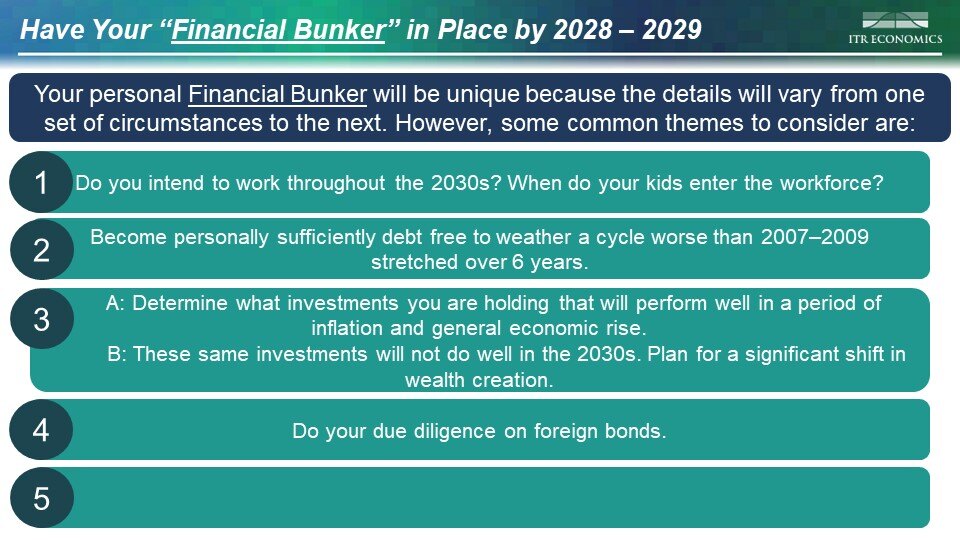

3 Reasons why you want to have a Financial Bunker

- Peace of mind going into a tumultuous time

- Positioning yourself to create wealth through the 2030s

- Cash is king at the bottom of a business cycle

We looked at the following in the prior two months:

#1: Do you intend to own a business or otherwise work through the 2030s?

#2: Become debt free.

#3A: Determine what investments you are holding that will perform well in a period of inflation and general economic rise.

#3B: These same investments will not do well in the 2030s. Plan for a significant shift in wealth creation.

Your Financial Bunker will be unique to you because your circumstances are unique to you. However, there are five broad common themes to consider. This month we move to #4.

#4 is Do Your Due Diligence on Foreign Bonds

ITR Economics has been a proponent of using the financial trends as a means of increasing wealth while also attempting to protect capital. The trend scenario we are anticipating includes:

- Inflation will be an increasing concern heading into the 2030s.

- Escalating inflation will lead to higher interest rates.

- Higher interest rates and demographic pressures combine to push stock prices down.

Our solution is to layer in bonds as part of the wealth management process as we end this decade and begin the next to lock in the higher coupon rates on the bonds. Longer terms to maturity normally provide higher coupon rates. Keep in mind that we are projecting that interests will be going through a major cyclical high early in the 2030s. Simultaneously, the intention is to lighten up on equity positions in light of the coming economic downturn.

[ Fill out our form to receive the full 5-step guide for building your Financial Bunker! ]

Folks who tend to want to minimize risk should consider foreign sovereign bonds. The coupon rate will be lower on these bonds than on US government bonds and corporate bonds. The lower rate on the foreign sovereign bonds will reflect what we expect will be a lower risk profile in our selected countries, because of economics and demographics. Folks that are willing to take on more risk may not want to eschew the higher coupon rates in order to maximize cash flow/current income. The situation is not binary; the mix should be considered on a sliding scale.

We think the move into bonds near the top of the interest rate cycle is one of the ways that individuals can maximize the potential of the shifting economic trends.

The way to go about investing in foreign bonds is not intuitive. Not all money managers are willing to make the process happen either. Part of the due diligence is:

- Determining how the shift in interest rates and investing in bonds could benefit you

- Finding out how the investment process works for foreign bonds if you want to avoid some risk

- Determining whether your current money manager is able to accommodate your needs

Join us on December 17, 2024, for our 2030s Depression Executive Series online seminar to learn more on this subject.

Next month we will look at Financial Bunker point #5: Have a strong tax advisor on your financial team.