With the latest data release from the Federal Reserve Board, 2024 is shaping up according to ITR Economics’ expectations, and if you have been following along with us, you know those expectations are not high.

As of the latest Federal Reserve Board data:

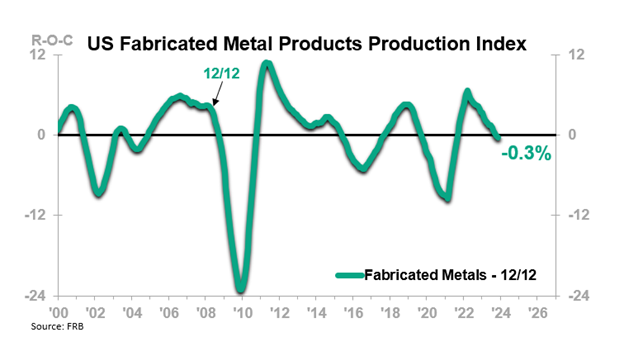

- US Fabricated Metal Products Production Index has transitioned to Phase D, Recession; the 12-month moving average is 0.3% below the year-prior level and declining.

This market is only the latest domino to fall.

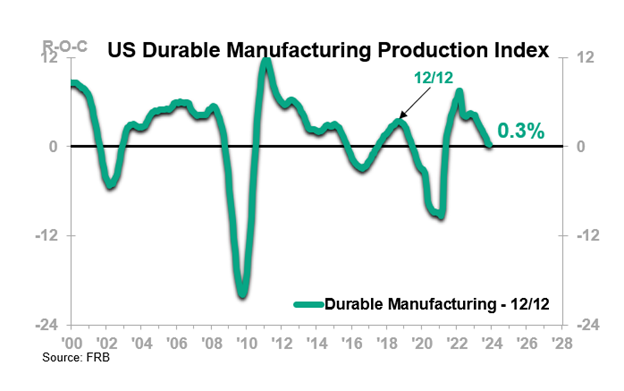

- As seen in the next chart, US Durable Goods Manufacturing Production – of which the above market is a subsegment – is barely hanging on to Phase C, and this is thanks mostly to its largest segment, US Transportation Equipment Production, which is still posting relatively robust, albeit slowing, growth.

Other subsegments of Durable Goods Manufacturing currently in Phase D include:

- US Machinery Production

- US Primary Metals Production

- US Electrical Equipment, Appliance, and Component Production

- US Wood Products Production

- US Furniture and Related Products Production

By volume of activity, these segments plus Fabricated Metal Products comprise about half of Durable Goods Manufacturing, meaning that about half of that subsector is in Phase D, Recession.

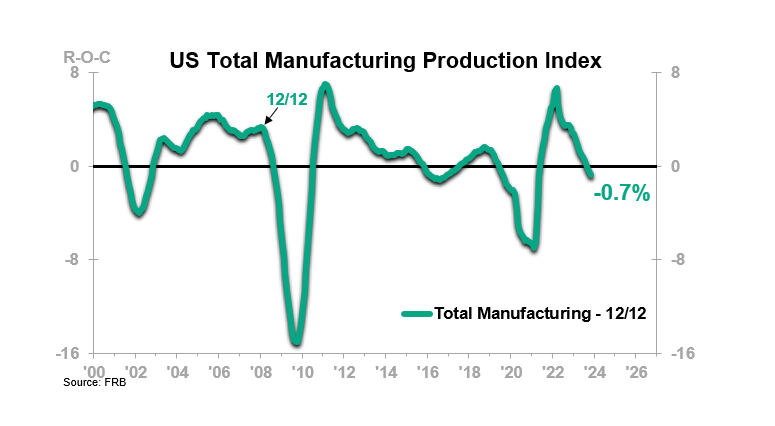

Meanwhile, the overall Nondurable Goods Manufacturing sector is in Phase D, and overall US Total Manufacturing Production, which includes both the Durable and Nondurable subsectors, is in Phase D. The Federal Reserve Board stated at its last meeting that it was still expecting a soft landing for the US economy, but these manufacturing datapoints – pulled from the Fed’s own data – are indicative of a hard landing per ITR Economics’ methodology.

Readers with business exposure to these Phase D markets should be closely watching their margins and cash position but should also lead with optimism. That does not mean denial regarding the industrial sector recession that is upon us, but rather a resolve borne of both the determination to succeed and the data-driven knowledge that the remainder of the 2020s after this downturn will offer growth-conducive conditions for those well-prepared to leverage them.

A Future Upside to Deteriorating Manufacturing Data?

It is important to note that the aforementioned datasets are compiled and tracked by the Federal Reserve Board.

- Effectively speaking, the Fed sets domestic interest rate policy.

- The Fed’s steep and frequent interest rate hikes in 2022 resulted in the inversion of the 10-year to 3-month Treasury yield curve, which was a major driver to our forecast for a mild industrial sector recession in 2024.

Tune into our weekly Fed Watch video series for more insights, but the deteriorating Manufacturing data outlined above is one more factor that could convince the Fed to begin lowering the federal funds rate early this year. If interest rates come down, it would likely result in the yield curve normalizing and ultimately establish a financial backdrop that will allow the mild recession to conclude around year-end.