Overview

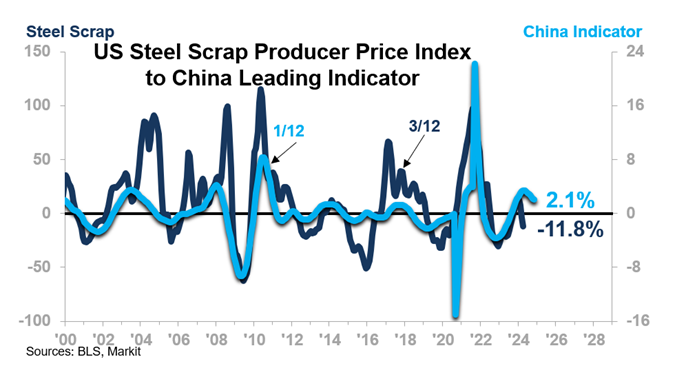

The US Steel Scrap Producer Price Index in the first quarter averaged 4.1% below the first quarter of 2023 (3/12 rate-of-change). Reliable leading indicators point to relatively flat Prices this year, with a slight downward bias. One of the watched leading indicators is the China Leading Indicator 1/12 (see chart below). Its importance is easy to understand given China’s weight in steel markets. The onset of weakness in the Leading Indicator’s 1/12 supports our outlook for the Steel Scrap Producer Price Index. Additionally, we expect a mild decline in segments of the US industrial sector through the rest of 2024. The recent weakening in Automotive Retail Sales also supports our outlook for Prices.

Expect the Steel Scrap Producer Price Index to rise in 2025 due in part to increased demand stemming from expected lower interest rates, an easing in quantitative tightening, stable to improving consumer finances, and a resulting improvement in overall industrial sector and macroeconomic trends.

Highlights

The China Leading Indicator’s trends paired with our domestic consumer and industrial outlook suggest the Steel Scrap Prices 3MMA will trend relatively flat this year.

Rise for Steel Scrap Prices in early 2025 will occur due in part to increased demand stemming from lower interest rates and other factors. The rising trend in early 2025 is projected to continue through the remainder of that year.

Why It Matters

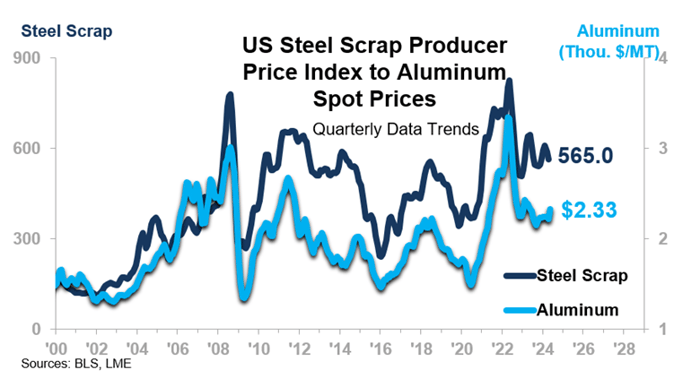

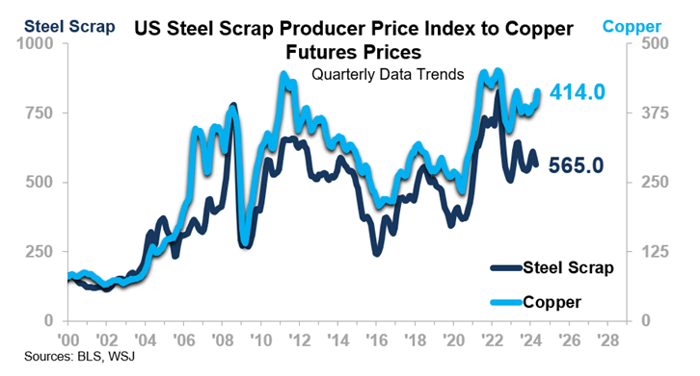

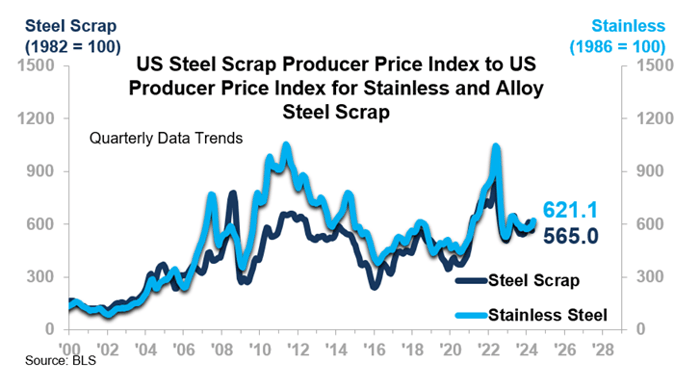

The Steel Scrap Producer Price Index encompasses a broad swath of the metals industry and measures the average change in selling prices of steel scrap over time1. It also signals what we can expect for: a) price levels for other metals and b) numerous other producer price indices.

Pricing Trends in Other Metals

Our outlook for a relatively flat trend with a slight downward bias for the Steel Scrap Producer Price Index 3MMA suggests similar trends for Aluminum Spot Prices and Copper Futures Prices (see charts below).

Stainless & Alloy Steel and Copper & Brass Producer Price Indices

Industry producers, distributors, and end users should plan on a measure of price stability as we move through the rest of this year and into 2025. Inventory purchases should be assessed in terms of both anticipated demand in 2025 and efficient-cost purchases later this year if leading indicators continue to show increased evidence of upward momentum for the general economy. Our ITR Trends Report™ (see itreconomics.com) will give you the confidence and forward view needed to maximize profit and performance potential.

1 Producer price index for iron and steel scrap in the United States. Includes heavy melting carbon steel scrap, carbon steel scrap bundles, shredded carbon steel scrap, cut plate and structural carbon steel scrap, stainless and other alloy steel scrap, cast iron scrap, and other ferrous scrap. Source: Bureau of Labor Statistics. The Producer Price index (PPI) is a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time. Source: US Bureau of Labor Statistics (BLS). Index 1982 = 100, not seasonally adjusted (NSA).