“The Economy is Strong.” No, it is NOT. Time for a reality check and to prepare for reality!

Essentially the only primary gauge regarding the US economy that is strong is the labor market, and that is a lagging indicator. If you look at the windshield instead of the rearview mirror, you see negative road signs.

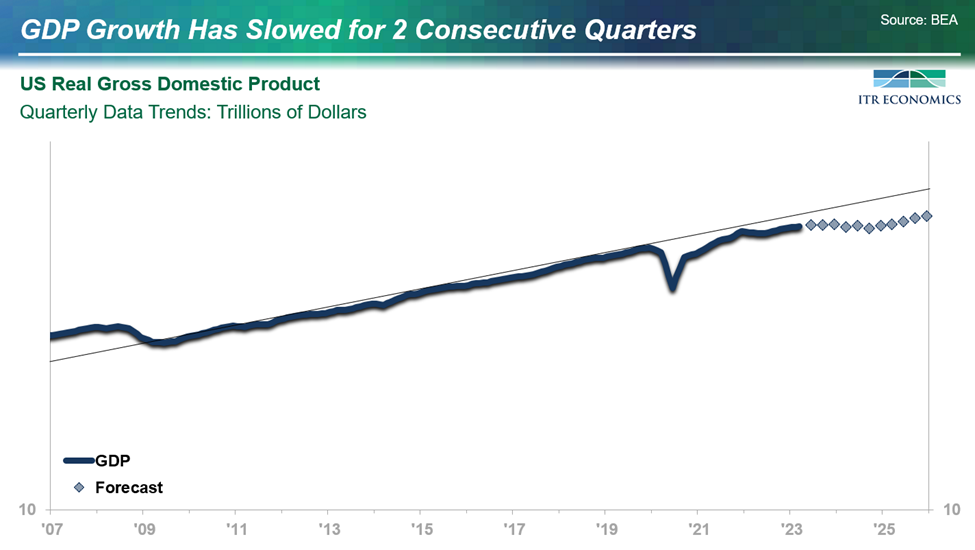

GDP

GDP (adjusted for inflation) experienced its second consecutive quarter of slowing growth. Based on leading indicators, we are on target with our forecast for minimal ascent this year and decline in 2024.

- Leading indicators are pointing toward decline.

- Retail sales are sluggish.

- April Retail Sales came in just 0.2% higher than the year before, and the seasonal trend is weaker than normal.

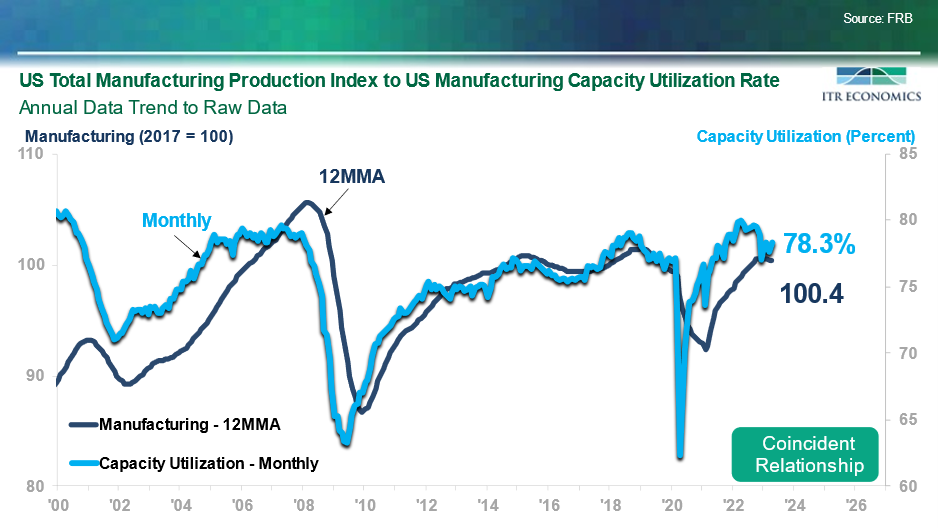

Manufacturing

Manufacturing over the last three months is running 0.6% below last year. While GDP is rising, manufacturing is not. The Manufacturing 12MMA data trend (pictured below) is stalled at best; it is down 0.2% from the November 2022 high.

- Further weakness is indicated by the decline in the Manufacturing Capacity Utilization trend.

- The Manufacturing recession is projected to persist into the second half of 2024.

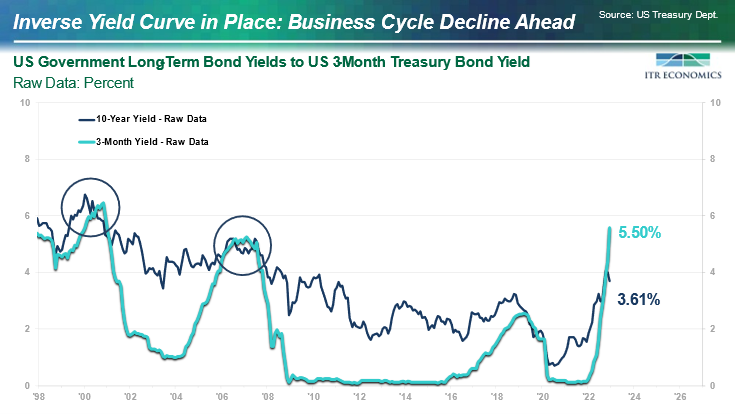

There is still a monster in the closet…

The inverse yield curve has not gone away. It will take the Federal Reserve reversing course and lowering interest rates for that to happen. Thus far, they exhibit no inclination to do so, because of the labor market. Their quest for wage price stability does not diminish the threat to the broader economic health posed by higher interest rates.

Based on prior inverse yield curves, there is only a 12% probability that the US will endure the current yield curve situation without having to pass through a recession.

Labor Indicators are Strong

This is true. However, there are signs of cracks developing in this perceived immutable strength. Keep in mind the following:

- Labor is a lagging economic indicator.

- Labor will not go down until after the recession begins.

- Obvious signs of labor market weakness will not present themselves until 1Q24.

5 Items for Your To-Do List:

Amongst the myriad of preparations, be sure to include the following:

- Assess your cash needs, as recession further tightens credit availability.

- Allocate labor resources to higher margin parts of the business.

- Identify which markets are likely to bear the brunt of the downturn (ITR Economics can help).

- Know how sensitive your business is to the interest rate environment as a means of knowing what damage may be coming your way (ITR Economics can help).

- Determine which leading indicators are pertinent to your business to better assess timing of a potential decline and, when the time comes, timing of the inevitable recovery (ITR Economics can help).