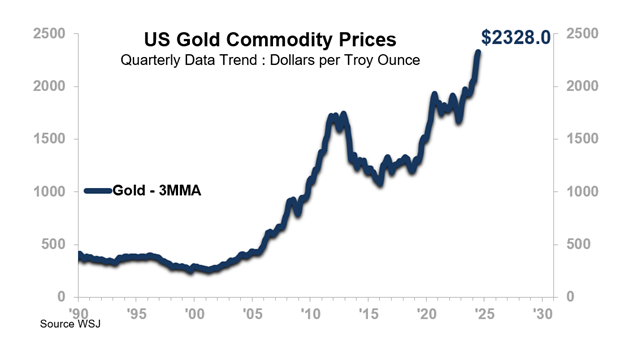

Gold is desired for many reasons, including Security, Status, Beauty, Utility, and Investment. The only reason contemplated here is investment. If you bought gold at the bottom in 2022, congratulations – your timing was perfect, and you are up 39.0% (3MMA basis, consistent with the chart below). Gold buyers did slightly better than the investors that “bought the market.” The 2022 average price is also provided in both cases because few people can time the market on a consistent basis.

Perfect timing off the 2022 low:

| Gold +39.0% |

S&P 500 +38.2% |

Since the 2022 average price:

| Gold +29.4% |

S&P 500 28.9% |

IF gold continues to move consistent with the S&P 500, our analysis of the S&P 500 suggests that gold will more likely than not move higher in the second half of 2024. There are times when people will chase after returns that have already occurred. Buying gold now would be such an occasion and would likely be part of a long-term buy-hold strategy. Since timing the market is difficult, an alternative would be to wait for a pullback in prices and then buy. After all, many folks have a preference for “buying low” and “selling high.”

Gold is currently rationally priced relative to the price of silver and copper and the US Producer Price Index trend. However, there are other metrics that suggest gold could be considered overpriced. They are:

- The value of the US dollar (Real Trade Weighted Exchange Rate)

- The lack of rise in the world M3 Money Supply as a percent of Global GDP

- Improving consumer expectations

- US Economic Policy Uncertainty Index decline

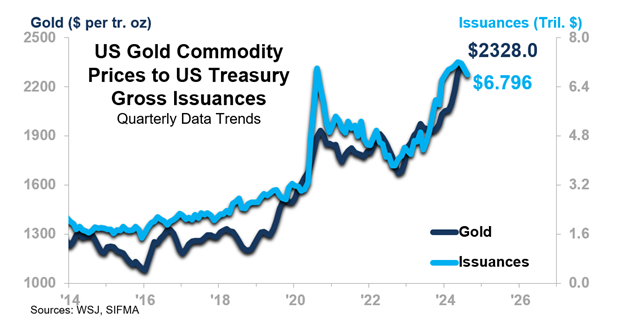

- A potential trend reversal in US Treasury Gross Issuances (see chart below)

None of the above pros or cons are so steadfast as to dictate what you should do in the next few weeks or quarters. Waiting to buy gold at a future low is logical for some, especially when you have alternatives in the interim. For others, timing the market is not something they care to do. For both camps, keep in mind that ITR Economics is advising making gold and other precious metals a significant part of your wealth-creating quiver in the 2030s.