Europe’s GDP (12-month moving average) is edging lower off a March 2023 record high. The second quarter of this year (three-month moving average) came in even with the year-ago level. The GDP 3MMA has yet to realize two consecutive quarters of decline, but Europe is on the cusp of a recession that will likely last through 2024. As with Europe overall, 12MMA decline is occurring in two of the European Union’s four largest nations: Germany and Italy. Germany is the fourth-largest country in the world (right behind Japan), and a recession in Germany does not bode well for the rest of Europe.

| |

12/12 |

Phase |

3/12 |

Phase |

12MMA |

| Germany |

0.2 |

C |

-0.6 |

D |

In decline off a March 2023 high |

| France |

0.7 |

C |

0.4 |

C |

Near-term decline anticipated |

| Italy |

1.5 |

C |

0.0 |

C |

In decline off a March 2023 high |

| Spain |

3.9 |

C |

2.1 |

C |

Decline anticipated |

Indications of Recession in Europe

Exports are a key component to economic growth in the EU. A decline in export activity results in a very noticeable indication of a reduction in international demand and thus domestic economic activity.

The following table shows exports as a percentage of GDP for 2022 (except Japan, which has the percentage for 2021). Other nations are shown on the list to highlight the significance of exports to the EU.

| Nation |

Exports as a % of GDP |

| Germany |

50.3% |

| Mexico |

43.4% |

| Italy |

37.2% |

| France |

34.0% |

| Canada |

33.7% |

| UK |

32.7% |

| China |

20.7% |

| Japan |

18.2% (2021) |

| USA |

10.9% |

The 3/12s are declining in Germany, France, and Italy. Germany and Italy are in Phase D with decline occurring in their export 12MMT trends. France is slowing and will likely follow the other two. Pain in exports in these countries is consistent with ongoing (or near-term) GDP decline in these countries and in Europe in general.

Retail Sales (deflated and excluding autos) are in recession in three key economies: Germany, France, and Italy. The decline in France is indicative of the anticipated recession in France’s GDP in the near term. The rate and depth of decline in Germany are particularly worrisome. Germany’s retail sales have dropped to the lowest level in three years. Italy’s have descended to the lowest level in just under two years.

| |

12/12 |

12MMA |

| Germany |

-4.2 |

Down a steep 5.2% off an April 2022 high |

| France |

-1.9 |

Down 1.8% off an October 2022 high |

| Italy |

-3.4 |

Down a steep 3.9% off a May 2022 high |

Permits for residential buildings in Germany, France and Italy are all declining and in Phase D.

Two Reasons Why This is Important

First, the EU’s combined GDP is approximately 18% of the world’s GDP, virtually the same as China, the second-largest single economy on the planet. It does not bode well for global growth if 18% of the world economy is slipping into recession, with the world’s fourth-largest economy (Germany) leading the way in Europe.

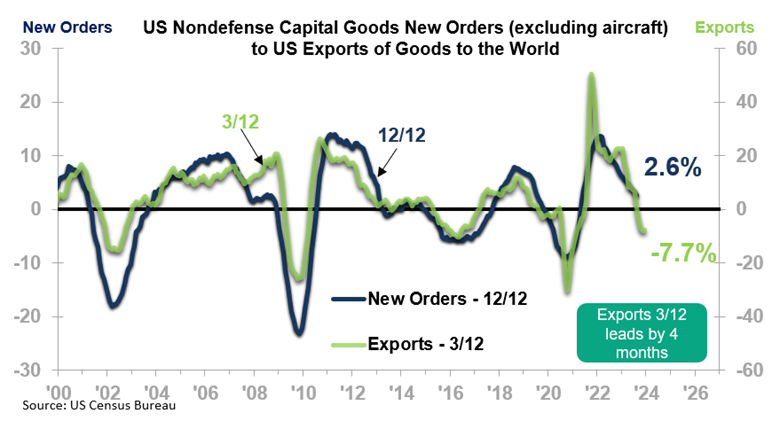

Second, economic weakness in Europe will contribute to further decline in US exports, and exports are 10.9% of US GDP. Currently, US exports to the world are down a steeper-than-normal 3.1% off a March 2023 record high, and the 3/12 is at -7.7%.

The chart below highlights the relationship between exports and Nondefense Capital Goods New Orders (excluding aircraft). The cyclical decline occurring in New Orders will continue into 2024 based on the existing trend in the Exports 3/12. The dynamic and duration of the exports 3/12 decline is consistent with our forecast for below-year-ago levels in New Orders activity in 2024.

Next Steps

This is the time to:

- Compare your rates-of-change to US export activity and to Nondefense Capital Goods New Orders (excluding aircraft) to determine if downside business cycle pressure will start (or continue). A solid comparison to the New Orders trend will also help you determine how long the downside pressure will last.

- Analyze your overall exposure to Europe in terms of direct market demand or, if your clients are EU focused and may experience a reduction in activity, secondarily. Adjust tactics and strategies accordingly to account for the risks and potential revenue impact.