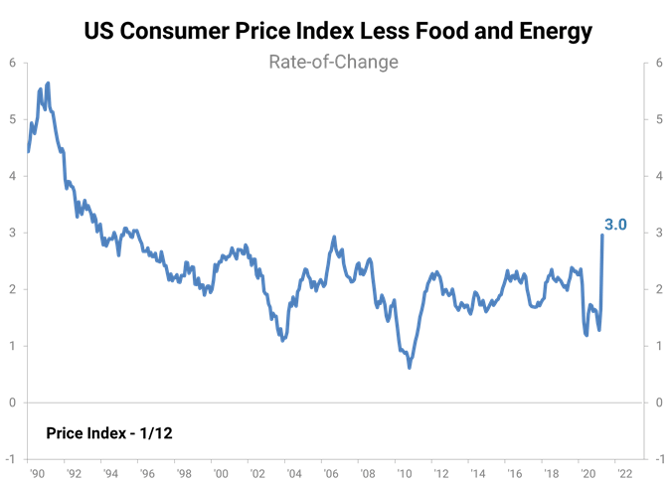

There is quite a bit of discussion regarding the threat of inflation and its attendant impact on interest rates. The CPI Less Food and Energy (so-called Core Inflation) is a close proxy for the inflation gauge the Fed uses. You can see that the Core Inflation rate rose to 3.0% in April. A 3.0% rate is noteworthy, but it is not cause for alarm if you are concerned about the Fed deciding it is time to move interest rates higher in order to curtail any imbedded inflationary pressures. They have indicated that they will tolerate a higher rate of inflation going forward for as long as a couple of years in order to balance out the periods when the Core Inflation rate was running below 2.0%. Bottom line: even with Energy up 25.1% in April from one year ago, the Fed is not expecting the increased inflation rate to endure long enough to force their hand and push interest rates upward.

While the CPI inflation rate is relatively tame, businesses are clearly facing inflationary pressures every day. Those pricing issues are picked up via the Producer Price Indexes. So far, despite the magnitude of input cost increases (including labor), the CPI is not indicating there has been a significant pass-through of these higher costs. That could become a serious issue for individual businesses. Be careful about your profit margins in this difficult environment. Additionally, on a more macro level, be mindful of the cumulative effect this margin squeeze could have on stock prices (further widening of the gap between high share prices and a tepid rise [at best] in profitability).

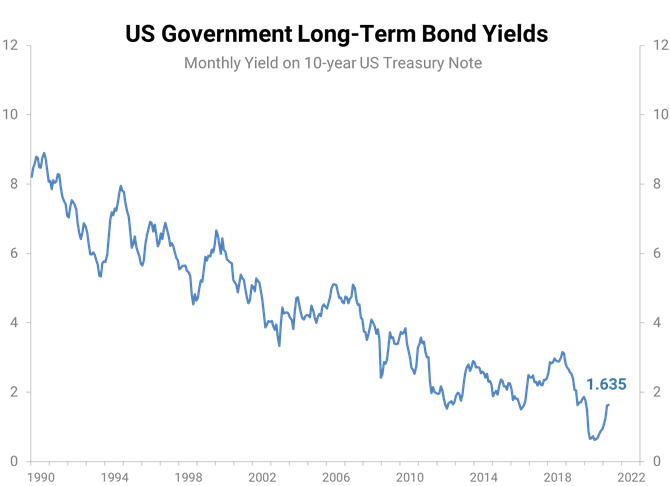

The next chart shows the US Government 10-Year Bond Yield through the same period as in the Core Inflation chart above. This long-term yield is a function of the marketplace, versus the short-term interest rates the Fed controls/influences. So far, the 10-Year Yield has returned to its pre-COVID level and nothing more than that. We are not yet seeing any inflation concerns from this trend. Additionally, the yield curve is favorable (positive) and is also indicative of low inflation expectations.

Don’t allow your own experiences with escalating cost inputs to lead you to conclude that interest rate rise is imminent and the economic recovery from the pandemic is drawing to a close. Stay aggressive in securing your supply chain and think about putting through another round of price increases. The consumer is flush with cash; they can absorb it if you can justify it. Now is the time to be laser-focused on your margins.

The three takeaways are:

-

-

-

-

-

1. The cost increases your business may be experiencing are not the inflation the Fed intends to do something about.

2. Interest rates look likely to stay low, and the economy will continue to power upward.

3. Raise your prices to protect your margins.

- Brian Beaulieu

CEO