3 Takeaways Regarding Contending With This Force in Your life

The US Consumer Price Index (CPI) showed 5.0% inflation in May, as measured by the Index change from one year ago. One year ago was the low point in the Index trend going through the COVID recession. That fact alone suggests the inflation rate (as measured by a year-over-year comparison) is likely to dissipate going forward. The chart below offers another view as to why disinflation (a diminishing inflation rate) is probable for 2022.

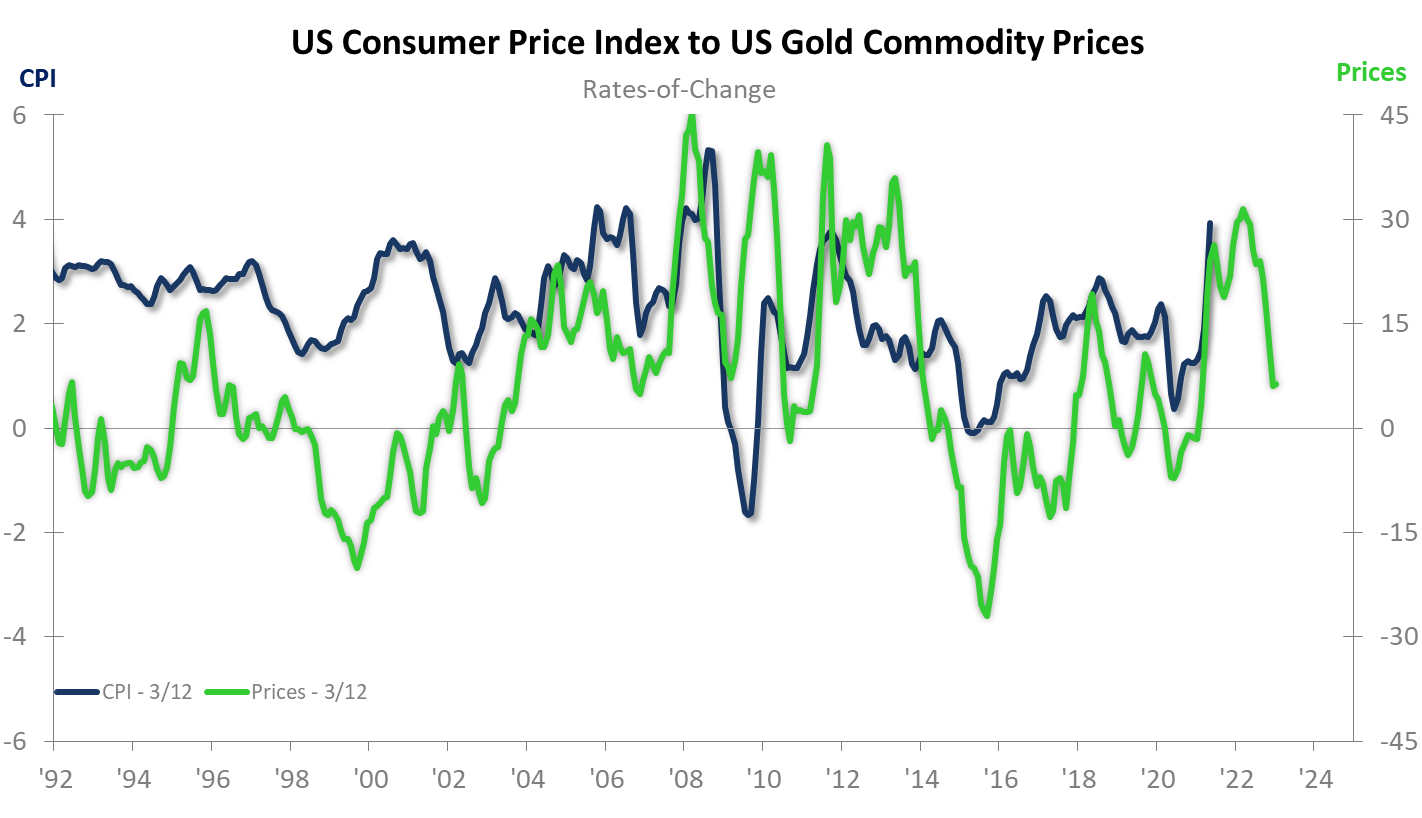

The Gold Price 3/12 rate-of-change passes through highs and lows approximately 20 months prior to the CPI. The Gold Price trend is shifted to the right (into the “future”) by the 20-month lead time to reveal the trend probabilities for the CPI 3/12. As the chart shows, the Gold Price trend is indicative of lessening inflation in 2022. We are projecting similarly diminished inflation for commodity prices beyond gold. That means the B2B inflation input is easing off.

First Takeaway: The current bout of inflation is transient and is not of long-term concern.

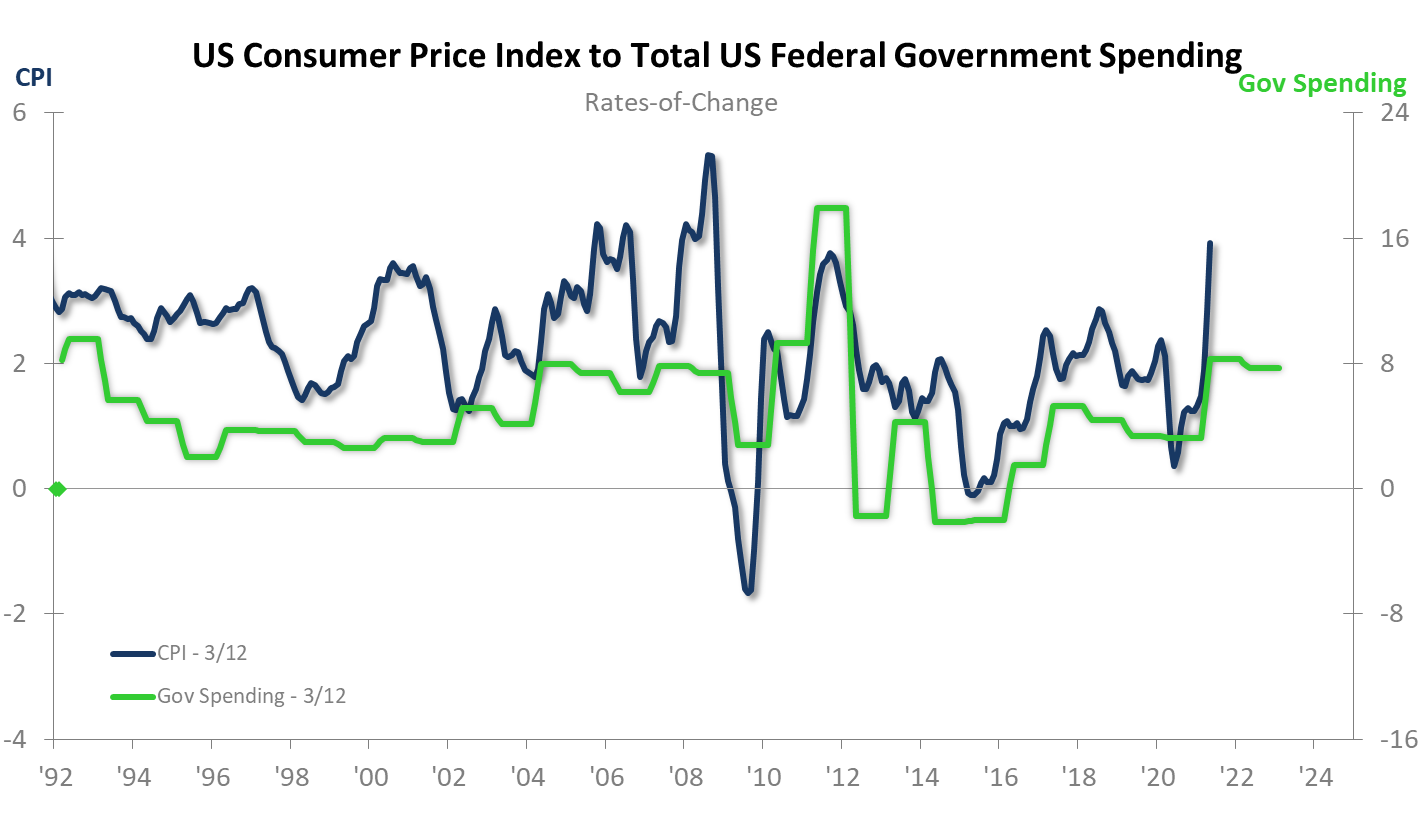

What lies ahead for the next cycle in inflation is not going to be like the last three that you see on the above chart. The stage is set for the next cycle to begin from a higher starting point. The next chart reveals a working relationship between the rate of rise in Federal Government Spending and Inflation. The Federal Spending 3/12 leads the CPI by approximately 26 months. The Federal Spending 3/12 rate-of-change is shifted to the right (also into the “future”) by 26 months to show us the associated trend probabilities. Assuming an increased amount of government spending is probable going forward given current policy tendencies, the next “business cycle floor” for the inflation rate will be 2.0% or possibly higher. That assumes there is some slowdown in the rate of rise in Federal Spending since the need for stimuli is diminishing.

The likelihood of seeing the Federal Spending trend go down to zero or below is not probable in our estimation. That means the next cyclical rising trend is going to get us to higher business cycle highs in inflation than we have become accustomed to because systemic inflationary fires have been lit.

Second Takeaway: Higher inflation is probable for the cyclical rising trend post 2022.

Higher inflation will lead to higher interest rates, but not immediately. The transient nature of the current round of price increases is the Fed’s perspective, and it is consistent with the bond market’s apparent view. However, in the next business cycle, when inflation begins from an elevated cyclical low point, the prospects for higher interests become more pronounced. We expect that the extent of the coming rising trend in interest rates will exceed anything we have experienced in the last 20 years. That will make it a brand-new phenomenon for younger Gen-X executives and for millennials. The cost implications for businesses in terms of borrowing for expansion/capital equipment, utilizing lines of credit, and having other firms pass along their associated higher credit costs will be a managerial challenge for many. Going beyond the business, the rising tide of interest rates will put downward pressure on share prices in many cases and the stock market in general. That will require a new paradigm for growing personal wealth in the cycles ahead.

Third Takeaway: The future in regard to inflation and interest rates will render the experiences of the last 10–20 years largely moot.

I pointed out in a recent TrendsTalk™ that we have the longevity of experience and understanding of the cyclical impact of rising inflation and interest rates such that we can work with businesses and leaders to shorten the learning curve; indeed, the goal (as always) is to keep you ahead of the curve.

- Brian Beaulieu

CEO