Five Points About the Tariffs from a Free Trade Economist

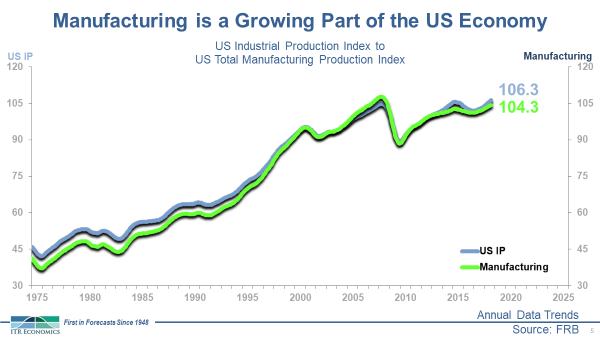

1. Breaking with some avidly free market schools of thought, I maintain that there is a time and place for tariffs. For instance, McKinley campaigned, and won, on a high tariff platform. It made sense because we were in an economic depression at the time, and it was expedient to distort economic principles to create American jobs. With that in mind, please check out the below chart, which shows that US manufacturing is growing without tariffs.

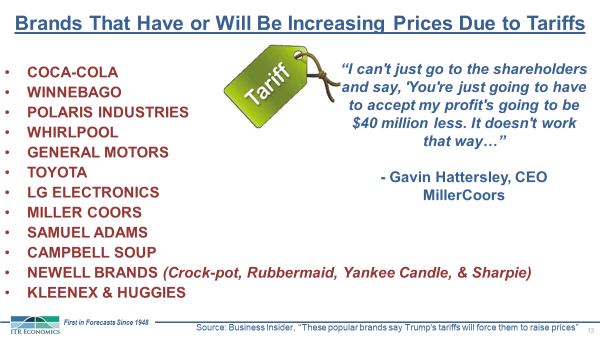

2. China is NOT paying for the tariffs. Importers pay the tariffs, not the Chinese exporters. That usually means US businesses pay for the tax through a reduction in their profits, or consumers pay for the tax through higher prices. What is true is that the US federal government wins. The tariff money flows into federal coffers as it is paid to the federal government at time of entry. The cost is then recouped down the line via price increases or diminished profits. Of course, this is offset by some businesses seeing additional activity (usually at higher prices, so again the consumer is paying). Good thing some of us got a tax reduction! The chart to the left includes a partial list of consumer companies planning on raising prices – and this was before the latest round of tariffs was imposed.

3. Countries are retaliating. This will not be good for many US businesses that rely on exports. Focusing on China, this is particularly not good if you have China-based companies among your major customers, or if you rely on the reality that

China is a driver for surrounding markets. Remember, it is all about profitability. You would be hard pressed to name a company of any size that is not exposed to China’s economy, either by exporting directly to China, by being involved in the domestic market within China, or simply by way of the fact that China’s economy drives the rest of Asia. If these tariffs are meant to hurt China, then we should be careful what we wish for.

4. The stock market has not yet responded negatively to the tariff issues. This could be for a myriad of reasons, ranging from the actual dollars involved relative to the size of our GDP, to an assumption that this is all part of a negotiating tactic, to a stronger focus on near-term corporate profitability. Our advice is to keep an eye on the market if trade issues continue to escalate.

5. The economic outcome of all this is likely a negative impact on the business cycle. On the surface, these negatives are somewhat balanced by the tax code changes, but it becomes a timing issue and relative game with the numbers. We will have more to say about this in the October 2018 issue of the ITR Trends Report™.

Brian Beaulieu

CEO