Last time the CEO Insights blog came out, we discussed the

3 Reasons why you want to have a Financial Bunker

- Peace of mind going into a tumultuous time

- Positioning yourself to create wealth through the 2030s

- Cash is king at the bottom of a business cycle

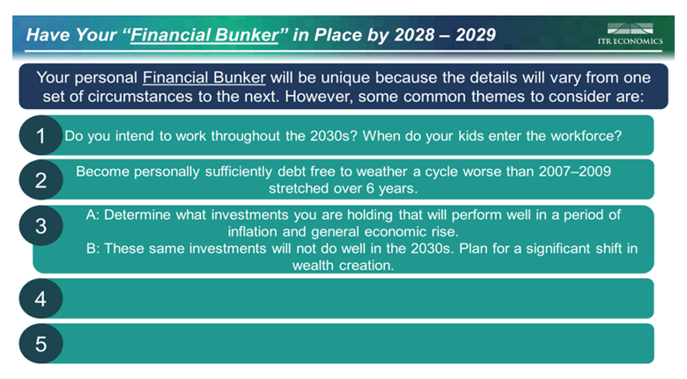

Your personal Financial Bunker will be unique to you because your circumstances are unique to you. However, there are five broad common themes to consider.

Last month we discussed #1 and #2 of those themes. This month we move on to #3 of the five components of a successful Financial Bunker.

#3A: Determine what investments you are holding that will perform well in a period of inflation and general economic rise.

#3B: These same investments will not do well in the 2030s. Plan for a significant shift in wealth creation.

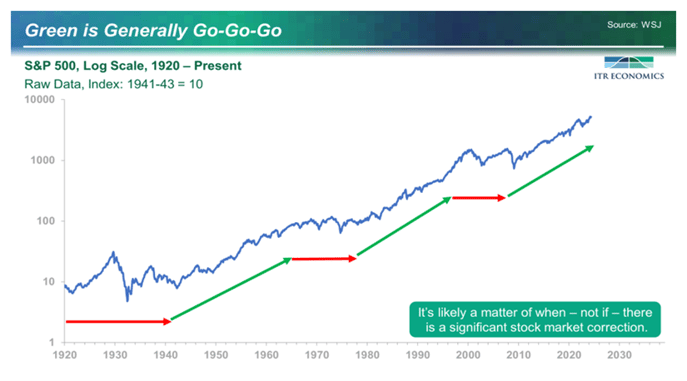

When the prevailing financial and economic trends are similar to those when the S&P 500 was rising (the “green arrow” periods), an investor in equities accepts volatility and likely some dry spells. The adventuresome consider how they can beat the market. That adventuresomeness will serve you well when it is tempered with a process.

[ Fill out our form to receive the full 5-step guide for building your Financial Bunker! ]

Climbing a New Mountain

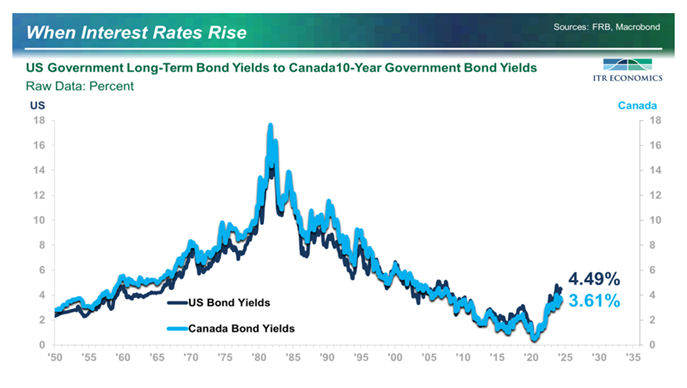

During the coming period of rising inflation, the interest rate trend is likely to resemble the period of the 1960s – 1970s. It is too far back for many of the people who are investing today to remember, but the notion of investing in bonds (especially with long terms to maturity) was a relatively foreign notion if you were still of working age. I vividly recall trying to convince people that buying long-term bonds in the 1980s was a smart economic move because they had fallen so far out of favor.

During the period of inflation as evidenced by rising interest rates, different asset classes besides bonds, frequently hard assets, were fundamental to wealth creation.

On the Other Side of the Mountain

While eschewing long-term maturities on bonds is wise for most folks when climbing the interest rate mountain, as we crest the peak and start down the other side, locking in high coupon rates with long terms to maturity becomes very appealing.

Unless you have an unlimited supply of money, you will want to shift asset class emphasis away from equities and into those long-term bonds.

Look at the first chart in the blog again. Having one’s wealth tied up during a period when equities will be hard-pressed to rise (for demographic and macroeconomic reasons) for 10 or more years will make shifting into bonds an easy decision.

The ratio of ownership between equities and bonds will flip as we cross over the interest rate mountain top.

Join us on July 25, 2024, for our next Executive Series Webinar on the 2030s to hear more on this subject.